Santa may need to consider moving with the times as we navigate the growing wave of social responsibility. On the one hand, reindeer power is about as green as you can get to power a vehicle, and on the other…..all that wrapping paper and packaging! Someone needs to tell him ESG does not stand for Extra Special Gift.

One of the recent benefits of the growth of ESG campaigns in financial markets is that the spotlight has moved beyond a focus on the social DNA of companies to invest in. Questions are now being asked about how all the companies who are active in financial markets are behaving. Could there be ways to introduce new practises and infrastructure in order to become more sustainable as an organisation, and as a community?

The exponential growth of ‘the computer’ in finance (as in other industries) is a well publicised story. The desire to beat your neighbour (sorry, serve your clients better) has fuelled an arms race. The current standard bearers claim to be pioneers in Artificial Intelligence and Machine Learning for optimised outcomes. There will be something new next year and it all leads to increased collection, storage and processing of the SAME data.

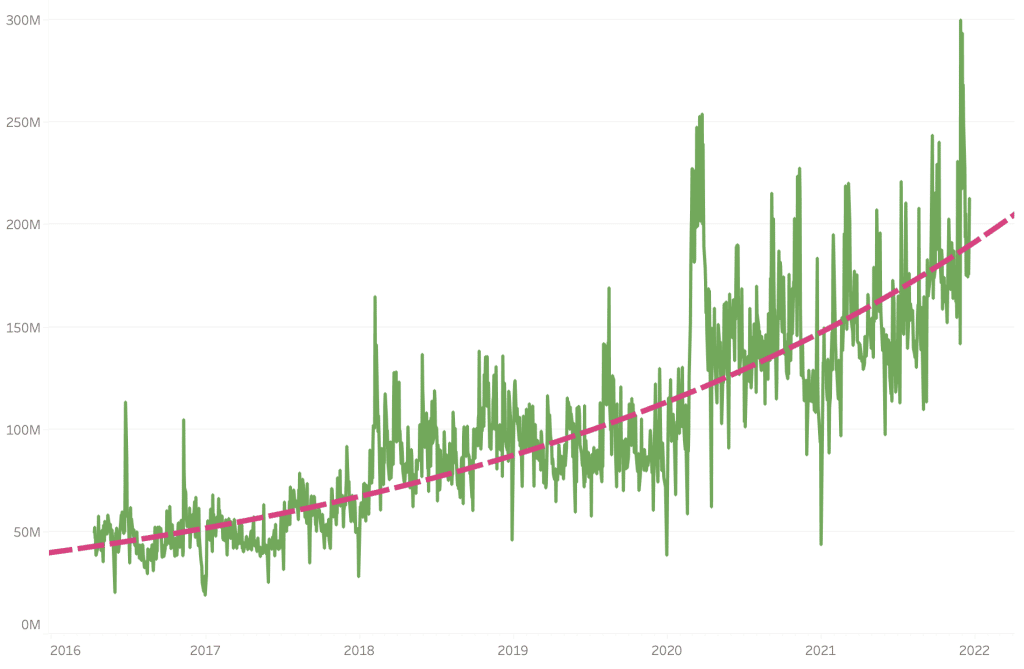

Chart one shows the growing number of order book we observe updates per day (including market depth) – for just a single market.

A few years ago when big xyt was formed, it wasn’t just the mathematicians and computer scientists who made the difference.

This article gives some indication of the volume of data we collect, curate and process daily, and we have to take responsibility, particularly in today’s world, for being efficient. However, as a nimble and self funded firm we have always had to be efficient and curious about new technologies that could help us to deliver more, with less effort, and without compromising on quality.

This extends beyond market structure and market quality analysis and execution analysis, and touches pre-trade analytics, portfolio construction, risk measurement and algo development, all of which can be performed independently using publicly available data (provided it is managed in a thorough and consistent way).

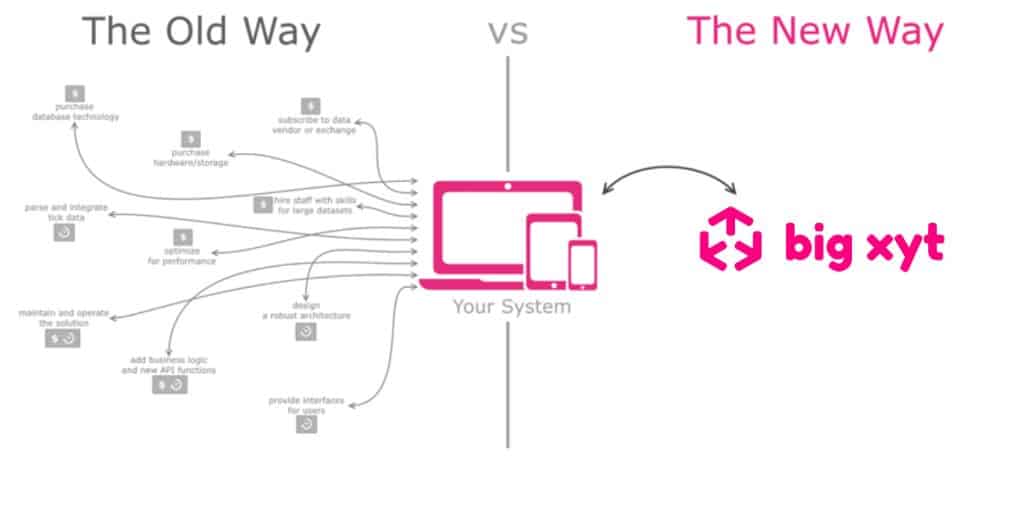

If your firm is digesting and analysing public data, you may want to investigate if aspects of it could be done on your behalf, allowing you to receive the results you need without duplicating the effort to get it in the first place.

There’s the added benefit for all the analysts, data scientists and quants wanting an easier life – it is much more fun to create results without the need to capture and handle all the raw data themselves.

If only Santa had this level of support, how much easier would his job be?

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.