By Mark Montgomery, Strategy & Business Development, big xyt

The introduction of the double volume cap (DVC) mechanism as part of MiFIR has heralded a new era in European equity trading, limiting for the first time the universe of securities that can be traded on dark pools. Nearly eight months on from the first DVC suspensions, we can begin to assess how the new regime is working and how the market is adapting.

When it first kicked off the DVC framework in March 2018, the European Securities and Markets Authority (ESMA) acknowledged that data quality and completeness issues had delayed implementation by two months, but since then it has kept its public register regularly updated to give market participants full transparency on instrument suspensions.

The latest update from ESMA on October 8th revealed 69 new breaches of the DVCs, taking the total number of instruments suspended from dark pool trading under the reference price and negotiated transaction waivers to 652. With suspensions lasting for a six-month period, the monthly updates now also highlight those instruments that have been liberated from the DVCs and allowed to return to dark pool trading.

Predicting suspensions

Important as ESMA’s monthly updates to its public register might be for the transparency of the overall framework, most market participants would not want to wait for a press release to find out whether or not a given security can be traded in the dark. Using data to analyse trading patterns and predict DVC suspensions offers a more compelling way to manage trading and order routing decisions and avoid sudden surprises.

Not every suspension is easy to predict, as market participants have already seen. BP is one of the largest and most widely traded stocks in Europe, but while the majority of FTSE100 stocks were included in the initial round of suspensions in March, dark trading in BP stock surprisingly did not exceed the DVC thresholds.

It was perhaps natural to assume BP might be suspended, but careful analysis of ESMA’s data shows that dark trading of the stock under the designated waivers actually fell below the 4% and 8% caps during the initial evaluation period, though those thresholds were subsequently exceeded and BP was therefore suspended later on.

Leveraging data and analytics

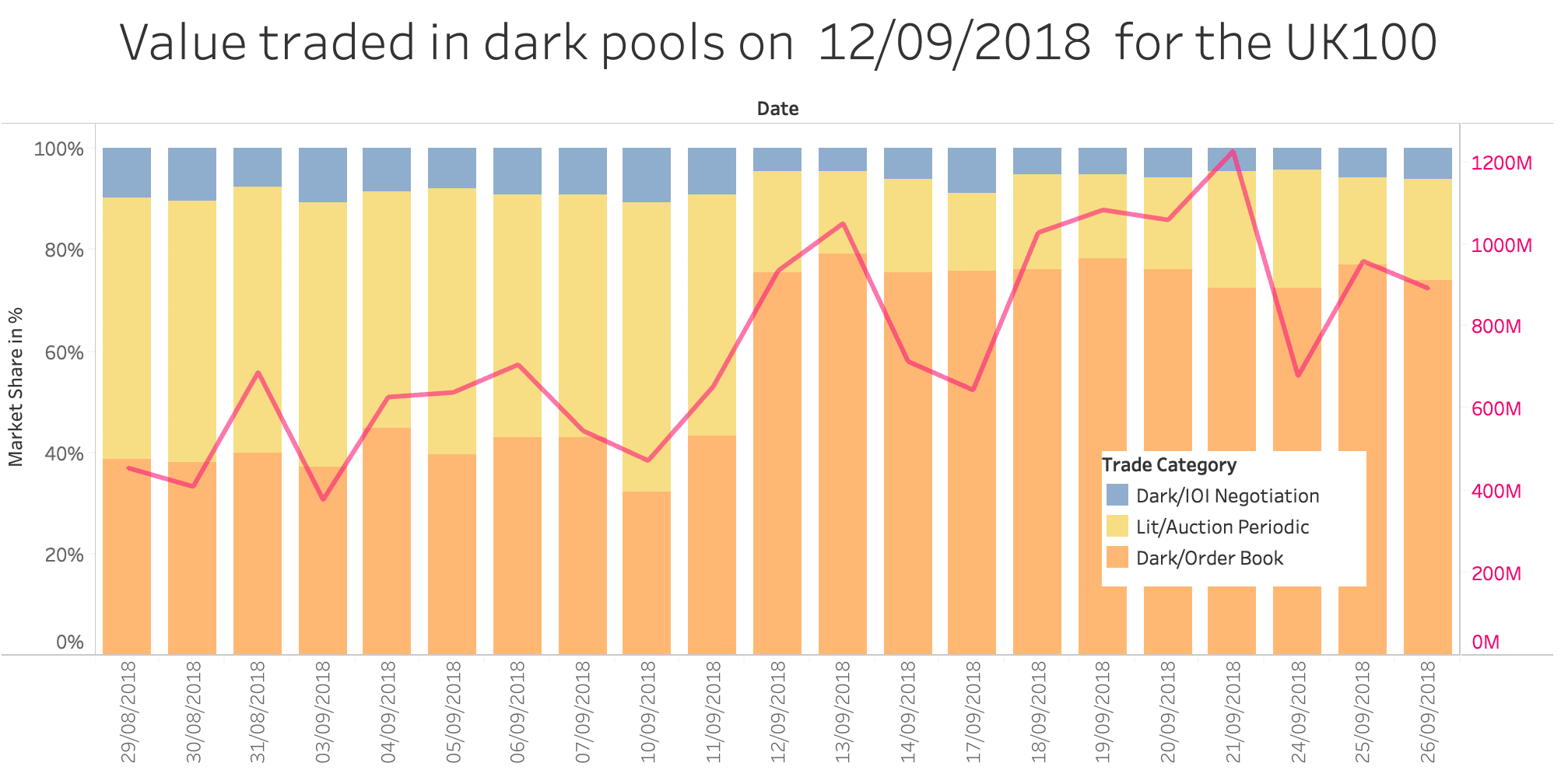

Whether or not the DVCs are achieving the objective of driving more trading away from dark pools and onto central limit order books is a question for regulators to address, but as the volume of historical suspension data grows, it will gradually become more apparent how the framework is impacting execution decisions and liquidity on trading venues across Europe.

By analysing the eligible volume in the stocks potentially affected by each successive round of ESMA announcements since March 2018, one can make certain assumptions about which stocks can be expected to be suspended in the future, and where trading in those names might shift as a result.

This kind of analysis is complex and involves the use of new data sets as well as a willingness to make certain assumptions and predictions, but it will be essential if the DVC framework is to be managed effectively in the future. Only with accurate data and sophisticated analysis will traders be able to pre-empt ESMA’s deliberations and make the right decisions in good time on how to route trades in securities that might be at risk of suspension from dark pools.