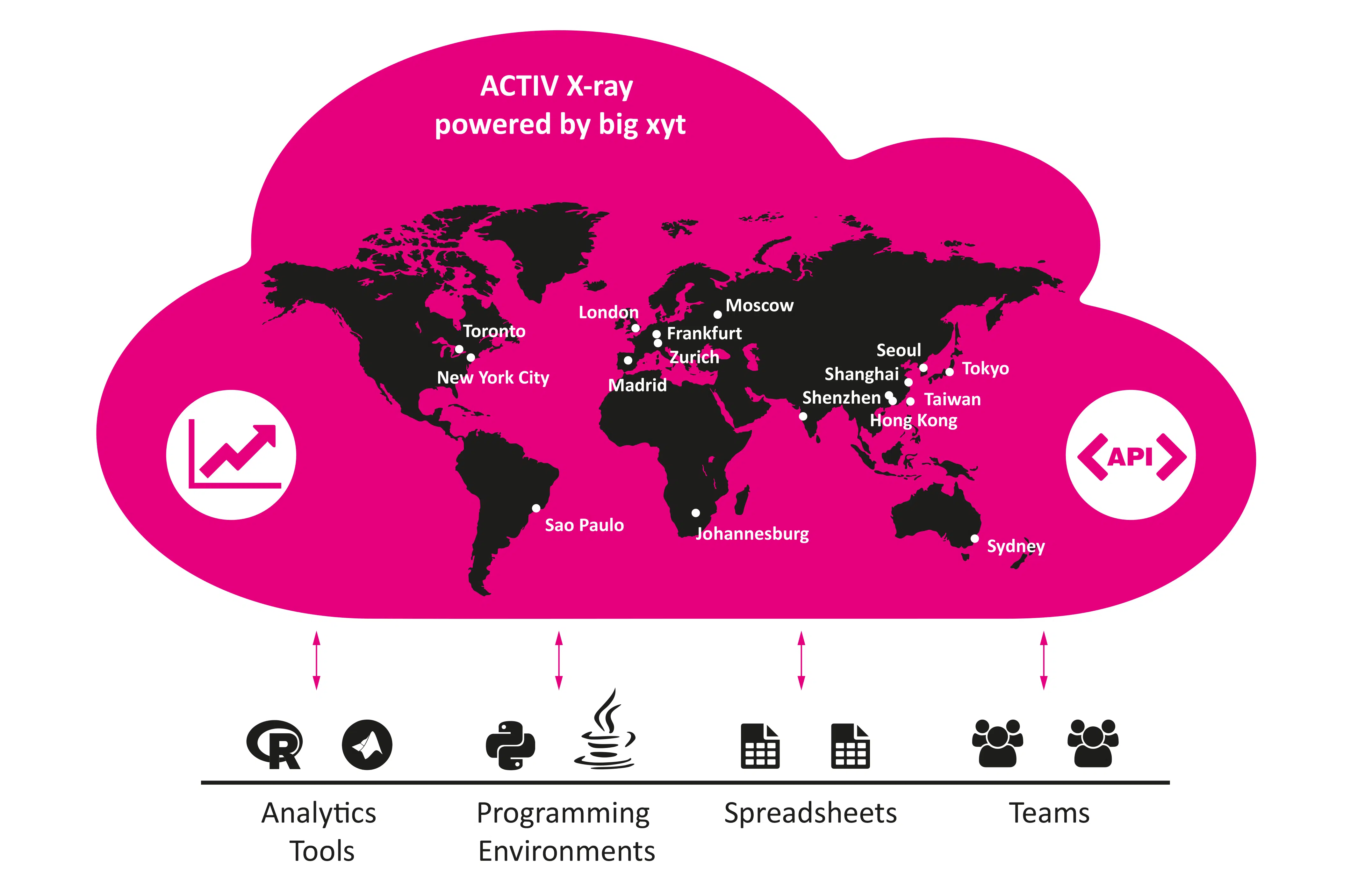

ACTIV Financial leverages big xyt’s Cloud Platform to enable immediate access to high-quality tick data and scalable testing of trading models.

FRANKFURT — 17 July 2016 — ACTIV Financial, a global provider of real-time, multi-asset financial market data and solutions, and big xyt, the leading provider for data and analytics solutions on large datasets, today announced the launch of ACTIV X-ray, a cloud-based tick data repository which will enhance the way trading firms discover and test new venues or meet ever growing regulatory requirements.

ACTIV X-ray provides a unique set of capabilities to rapidly turn market data and analytics into business value:

- Global Coverage – Access to high quality historical tick data from more than 80 trading venues globally.

- API Access – Integrate seamlessly with any programming environment including Java, Python, R and MATLAB.

- Back Testing – Test trading models on high-quality tick data (including BBO and market depth).

- Market Impact Analysis – Optimize your trading and execution strategy with unique KPIs.

- Best Execution – Compare trading activity across multiple venues and dark pools.

- Market Replay – Understand and review market events step by step.

ACTIV X-ray is a complete turn-key solution including tick data, hardware, hosting and operations. This means clients do not need to purchase data or build and manage an optimized tick data infrastructure allowing them to focus on their core business.

“ACTIV X-ray affords the trading community access to high quality historical tick data, without the burden of investment in significant data capture and storage infrastructure, delivered in a variety of analytics packages developed with our partner big xyt,” said Ben Collins, Managing Director Europe, ACTIV Financial.

“Engineering and operating ACTIV X-ray makes us very proud as we delivered a leading tick data cloud to the global trading community,” said Robin Mess, CEO, Co-Founder, big xyt. “Our Cloud Platform allowed ACTIV Financial to launch an innovative product immediately and provide clients access to their historical tick data base effortlessly.”

About ACTIV Financial

ACTIV is a global provider of real-time, multi-asset financial market data and solutions. ACTIV offers neutral, managed services for buy and sell-side firms and technology providers seeking a complete market data solution that encompasses both global content management and data delivery. With coverage spanning more than 200 equity and derivatives exchanges around the world, ACTIV is the only truly end-to-end, independent market data utility in the industry. Founded in 2002 by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London. More information can be found at www.activfinancial.com.

About big xyt

Since 2005 the big xyt team has provided global corporations in the most demanding domains with the fastest, most efficient, and most convenient solutions for processing real-time and historical data. This focus has enabled us to become the leader and most innovative company in high-volume data analytics.

Today big xyt engineers and operates solutions for storing and analyzing large amounts of data, enabling customers to transform data into information and decisions instantaneously. This allows corporations to innovate in remarkably fast and efficient ways, making this capability an essential corporate asset, and a competitive advantage.

Learn more about ACTIV Financial: activfinancial.com

Contact information

Learn more about big xyt: big-xyt.com