As our 12 Days of Trading campaign 2020 draws to a close, we know you like a festive finale. A global view of equity data allows us to zoom in on specific regions or individual markets. So, just like Santa, you can see everything.

In another demonstration of how smart analytics can be powered by a global vault of data, we switched on the lights for the top 30 Nasdaq stocks since the beginning of September.

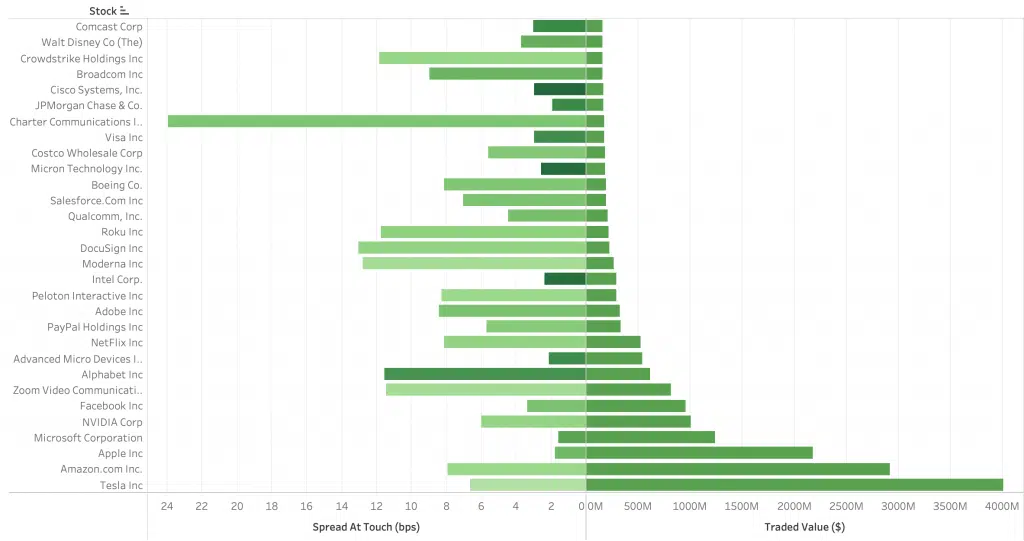

This year’s Christmas tree is constructed with Nasdaq analytical branches.

On the right side of the tree is a (reverse) ranking by traded value on the Nasdaq continuous order book only.

On the left side we see the (at touch average) spread in basis points for each stock.

At this point we (our super smart team) added another dimension – shading the colour on the spread bars to indicate Quote to Trade ratio for each stock.

Although intended as a fun image, there is an intentional desire to show the power of using appropriate visualisation tools to make complex and sizeable raw datasets tell a simple and insightful story. In this case the Quote to Trade ratio is quite consistent with one exception: Alphabet (any suggestions why?).

For all other stocks a high (darker) Quote to Trade ratio is correlated with tighter average spreads. This might be expected as liquidity providers compete in areas where they feel they can most actively participate, help to facilitate trades, and hopefully (for them) profit from the increased involvement.

Let us know what you would like to achieve with your data analytics, globally. We are here to help… and we love a challenge!

*****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe for 2020, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.