Sharing a few of OUR FAVORITE STORIES FROM 2019 with you!

As we set forth into a new decade with 20:20 vision, we thought it would be appropriate to share some memories and developments from an award winning year for big-xyt in 2019. Most, if not all of these enhancements germinate from client conversations. We value feedback highly and would encourage you to continue to challenge, encourage and share thoughts with us.

Looking back at 2019, we can see many ways in which big-xyt has developed, not just as an independent reference for European Equity market structure but as an external source of unbiased analytics, accessible & integratable through a unique proprietary API. Please let us know if you would like to know more about these services.

Wishing you a successful, enjoyable & insightful 2020.

The big xyt team

12 DAYS OF TRADING (with apologies to the partridge!) Our festive trends & snapshots of European Equity Markets.

1st Day of Trading Impact on Liquidity for the LSE Stock

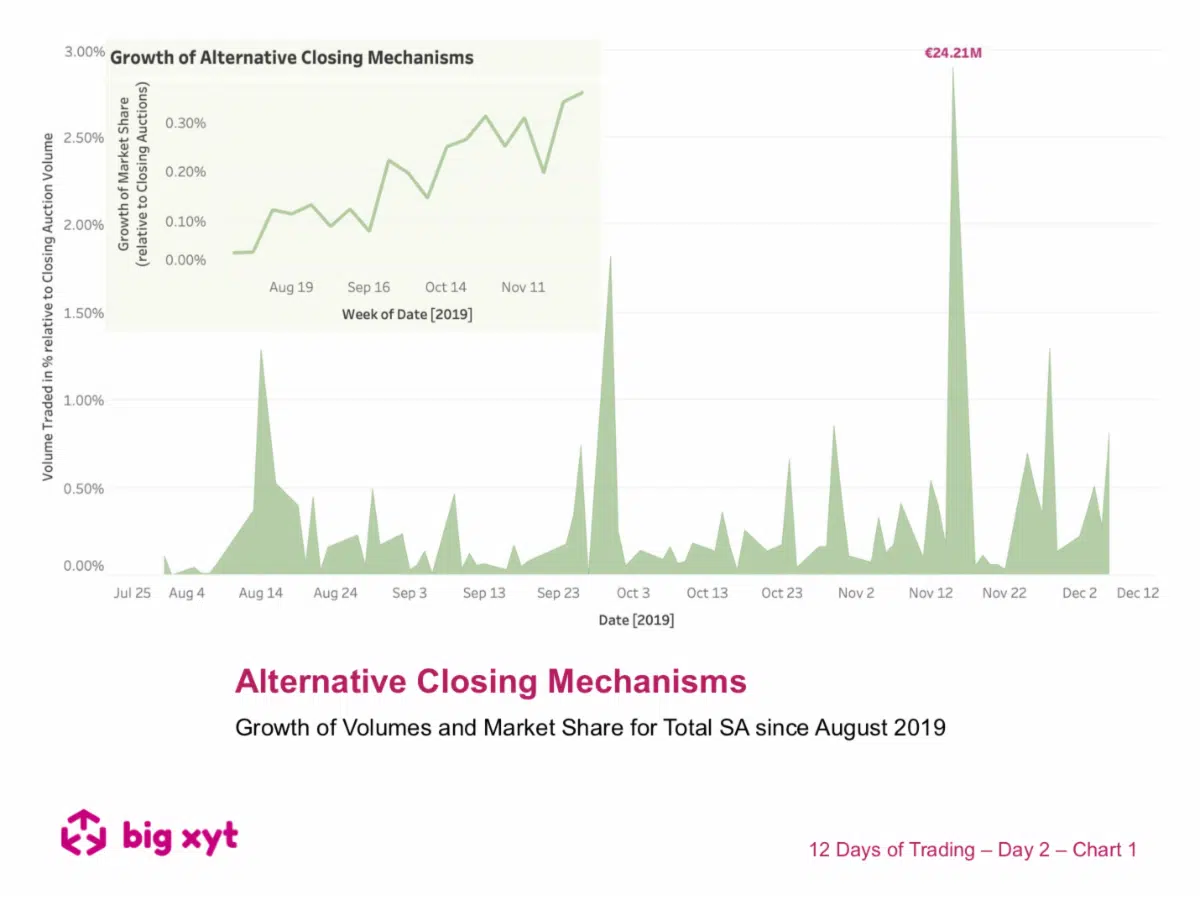

2nd Day of Trading Alternative Closing Mechanisms

3rd Day of Trading Liquidity vs Turnover

4th Day of Trading Day of Trading Periodic Auctions

5th Day of Trading Price Movement

6th Day of Trading Day of Trading Election Results

7th Day of Trading Day of Trading Volume Profiles

8th Day of Trading Day of Trading Total vs Adjusted Volumes Traded

9th Day of Trading Day of Trading Opening Auction Activity

10th Day of Trading Day of Trading Price Movement – Closing Auctions

11th Day of Trading Day of Trading Price Movement by Venue & Mechanism

12th Day of Trading Day of Trading Merry Christmas

Product News

XYT View launched in response to market demand for independent overview of fragmented European equity market.

Liquidity Cockpit is now used by all major exchanges and MTFs, leading sell-side clients and a growing number of buy-side users.

big xyt analytics platform has been extended to include Transaction Cost Analysis (TCA).

and ….. Leading financial institution switches TCA provision to big xyt, enables development of next generation execution analysis.

Consolidated View – Independent reference of market share, liquidity and trends now available for Equities and ETFs.

big xyt Opinions

Beyond the Consolidated Tape: Finding a Better View of the European Equities Markets

How price movement measures can inform execution decisions

What Others Think

New collaboration with Steve Grob brings additional market structure expertise (and some fun blog posts) to the team.

Meet the Team

big xyt regularly attend and exhibit at events across Europe

Robin Mess talking about the challenges and future of the industry at TradeTech 2019

big xyt sponsored the Liquidity Bar at the Financial News Trading & Technology Awards 2019 at the V&A in London

We hope to see you in 2020

Trading Tech Summit – 25 February

EMEA Trading Conference – 12 March

Plus regular Trading Briefings

21-23 April in Paris

And the Winner is … Us!

“The TRADE editorial team were impressed with big xyt’s quality of service and high level of dedication to providing the buy-side community with tools they need to achieve best execution and deliver the best returns to clients as possible.”

Want more information?

With all major Trading Venues, and a significant number of Buy-side and Sell-side firms now relying on big xyt to provide the detailed, reliable and completely independent market structure and trading analysis for European equities and ETF markets.

NOW is the time to find out more