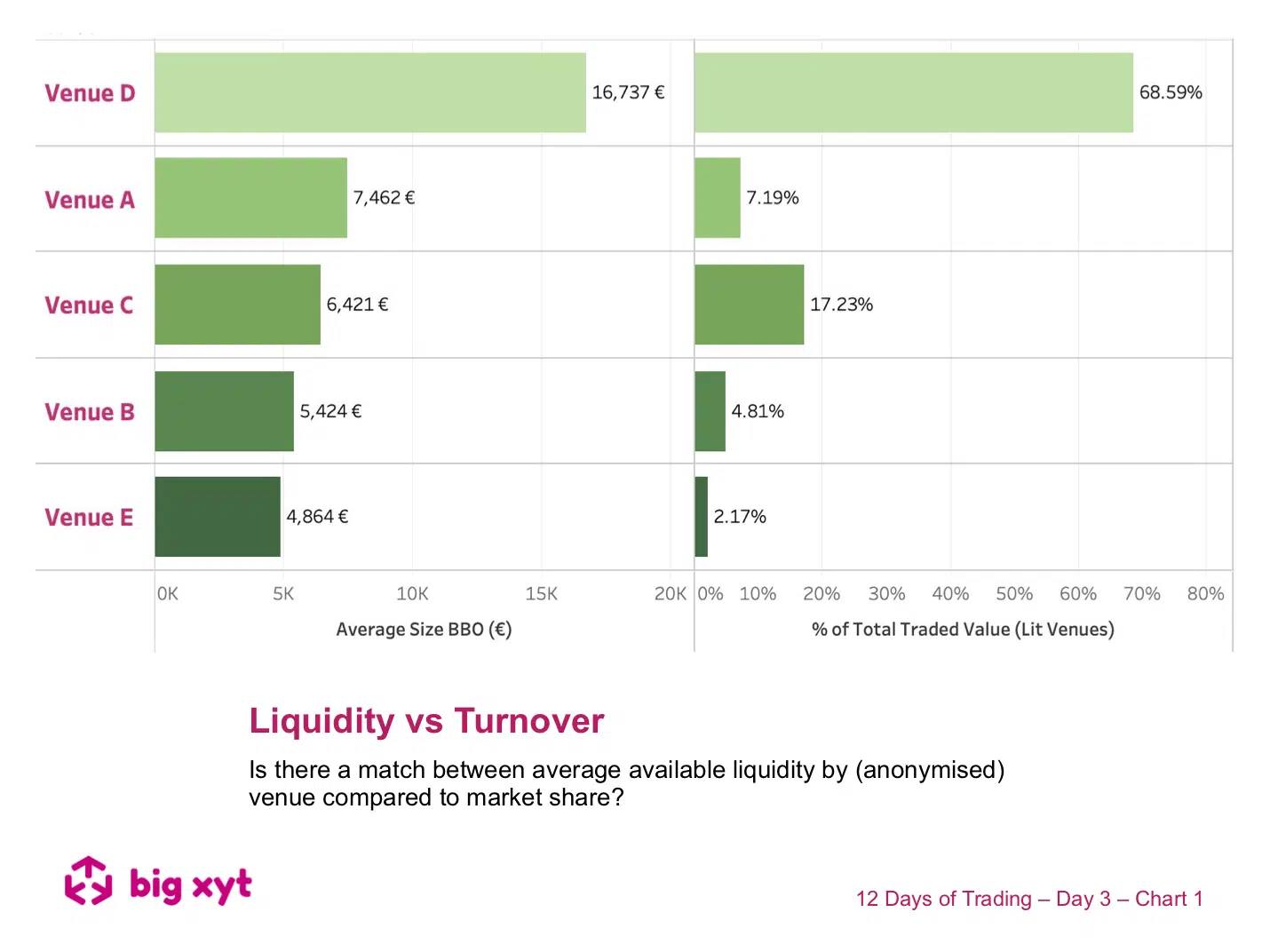

We have demonstrated in previous posts that there is a correlation between spreads and market share. The venue with the highest turnover tends to have the best prices. However, as the regulators keep reminding us, best execution should factor in liquidity as well as price. In the chart today we take a look at one European market and find that the rankings for turnover do not always match the rankings for available liquidity at the touch across the anonymised venues. Our Liquidity Cockpit allows the identity of these venues to be revealed to enable you to ask if you are sourcing the best liquidity, at the best price, by market, by venue, by index or at stock level. — Do you want to receive future updates directly via email? Use the following

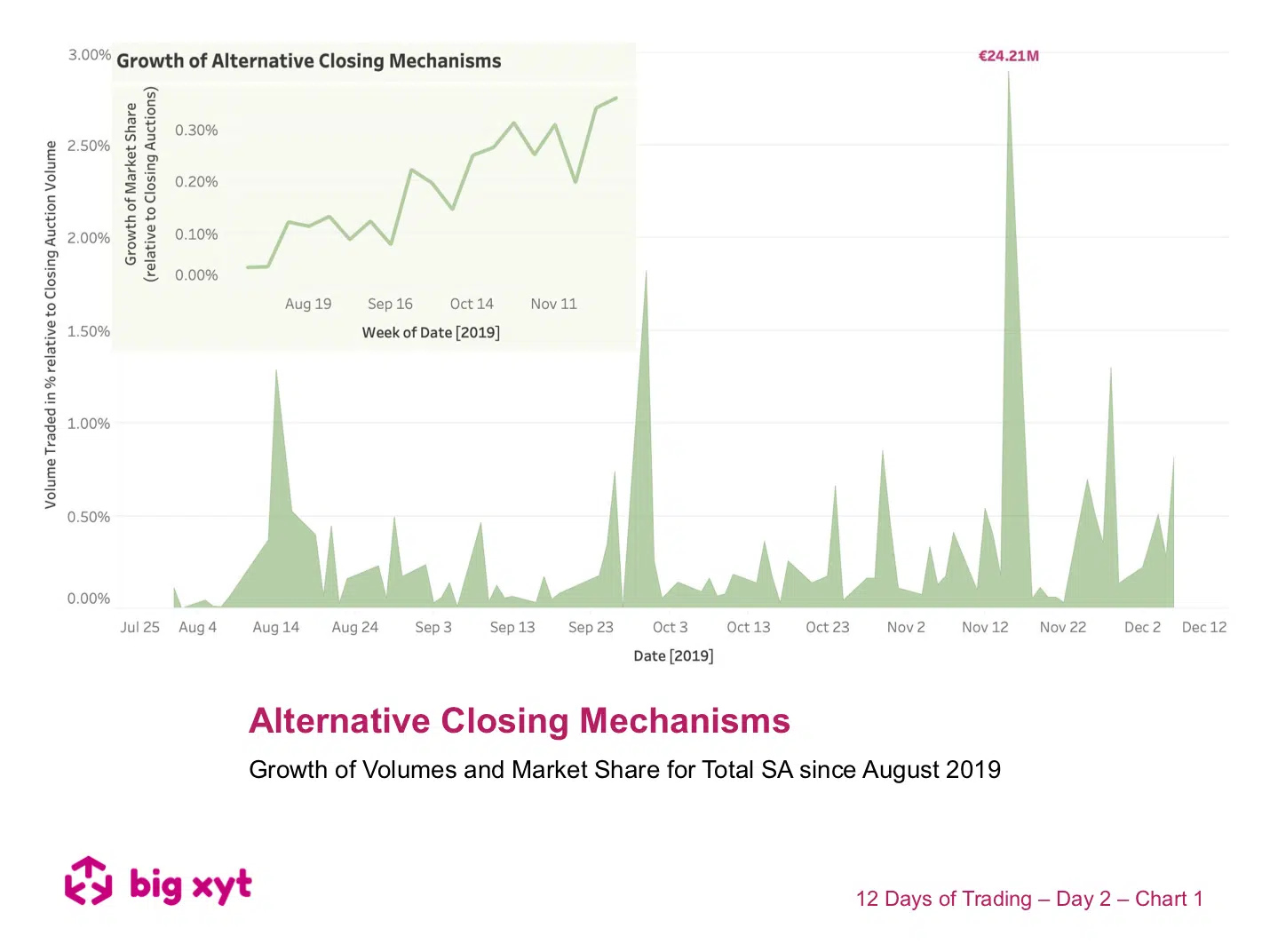

MiFID I opened the door to exchange competition in Europe. Whilst the central limit order books of the exchanges have seen their monopolies challenged, one area has remained the domain of the primary exchanges. However, with increasing focus on closing auctions driven by passive investing and ETFs, it is not surprising to see innovative attempts to provide alternative means to deliver execution at the closing price. Many exchanges already support a post trade phase (Trading at Last) sweeping up remaining interest once the price has been established. Aquis and Cboe have recently introduced their own twist on the Primary mechanisms. Today’s chart shows that investors looking for liquidity at the closing price need to be aware of the growth of alternative mechanisms (shown in the inset), and taking the example of Total we see growth overall and in the monthly peaks traded

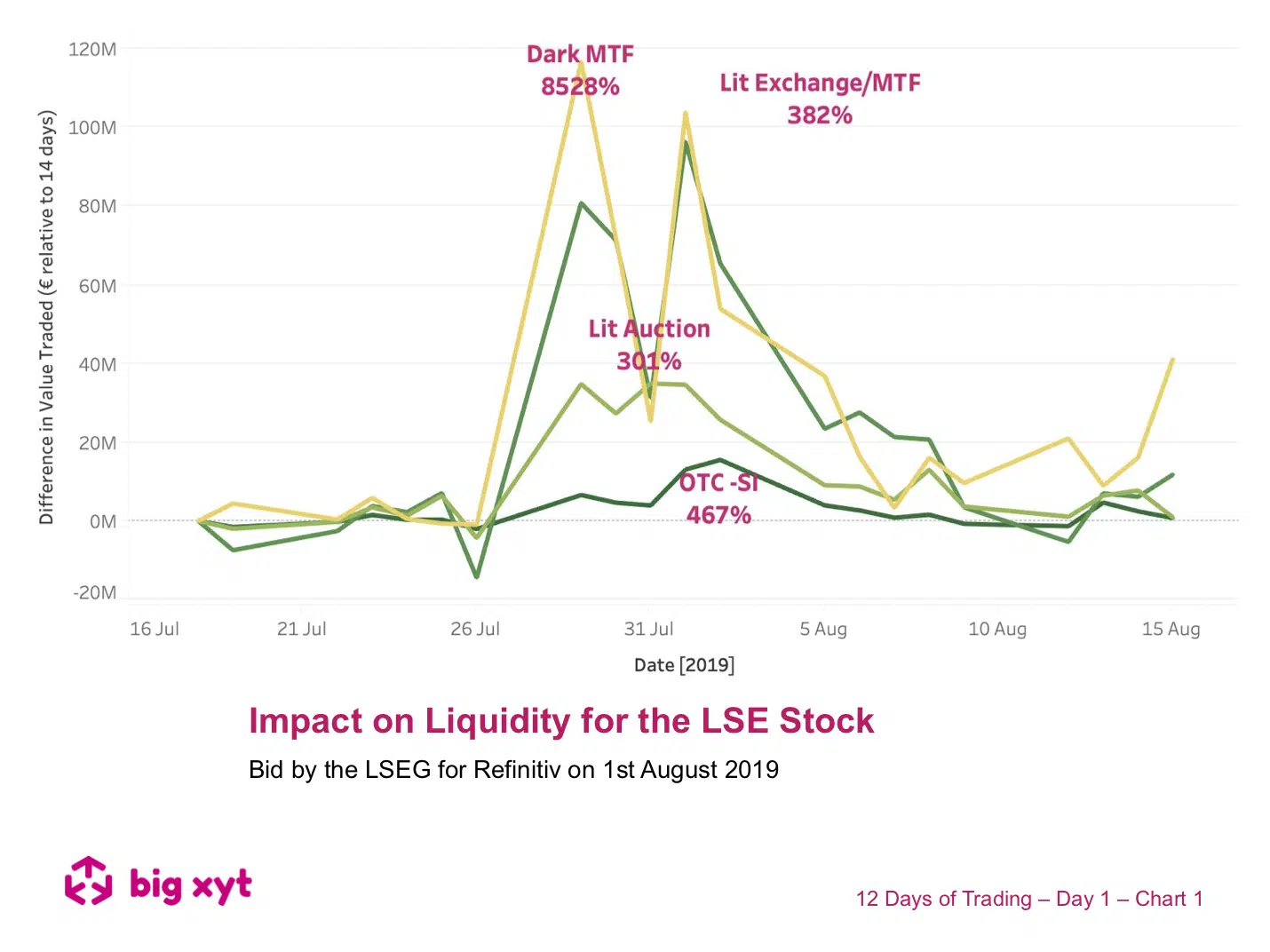

Liquidity on lit order books is driven by pre-trade transparency. Therefore, tighter spreads or deeper visible liquidity can lead to market share growth on one venue at the expense of another. Alternative mechanisms also play their part in particular circumstances. Take the example here where major news on two occasions throughout the year caused a basis change in the price of the London Stock Exchange Group (ironically the owner of three major European Equity venues). Traders noting a new price level wanted to trade and trade in size. With the news leading, to increased activity, the fragmentation of liquidity changed in a somewhat unexpected way. Market Share in lit books and block volumes increased dramatically compared to other mechanisms. Of further note was that this increase persisted in block venues, not just for the duration of the day of the announcement but for subsequent days until matched block liquidity was exhausted at that price level.