big xyt shares independent insights on European trading derived from a consolidated view on cash equity markets. The measures covered below are used as a reference by exchanges, brokers and buyside firms, reflecting answers to relevant questions occuring in the post-MiFID II era. The methodology is fully transparent and applied to tick data captured from all major venues and APAs (Approved Publication Arrangements). During the first half of 2018, market participants and observers are continuing to evaluate the changing liquidity landscape of European equities. One of the key questions this year is around the introduction of a ban on Broker Crossing Networks (BCNs), thereby outlawing the matching of a bank or broker’s internal client orders without pre-trade transparency for the rest of the market. Would this ban effectively force BCN activity onto the lit markets (public exchanges), as intended by the regulator with its desire to maximise the transparency of all orders, both pre- and post-trade,

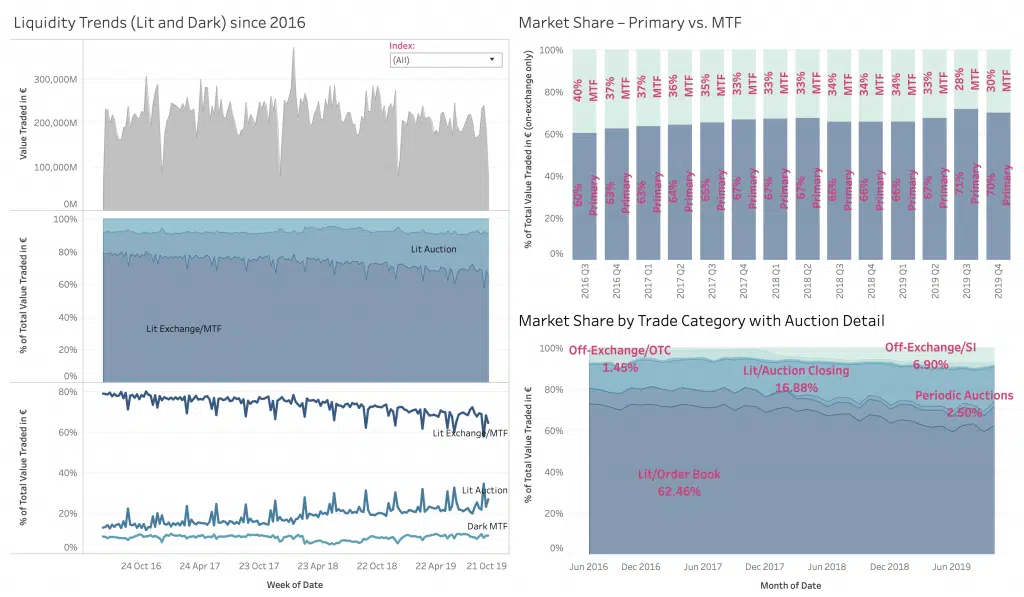

ondon, Frankfurt, 3rd October 2019 – big xyt, the independent provider of market data analytics, today launched XYT View, a specialist aggregated view of fragmented market information that participants need to ensure that they are achieving the best possible outcomes for themselves and their clients. The company is also pleased to announce that Steve Grob, CEO at Vision 57 and “long time” market commentator will be working with the Strategy team to provide market consultancy and additional thought leadership. XYT View provides a meaningful range of market overview metrics and has been developed to fill the information gap caused by the withdrawal of previous alternatives. Delivered via interactive dashboards, users can observe changes in displayed liquidity, periodic auctions, opening and closing auctions across the entire equity and ETF trading landscape in Europe.