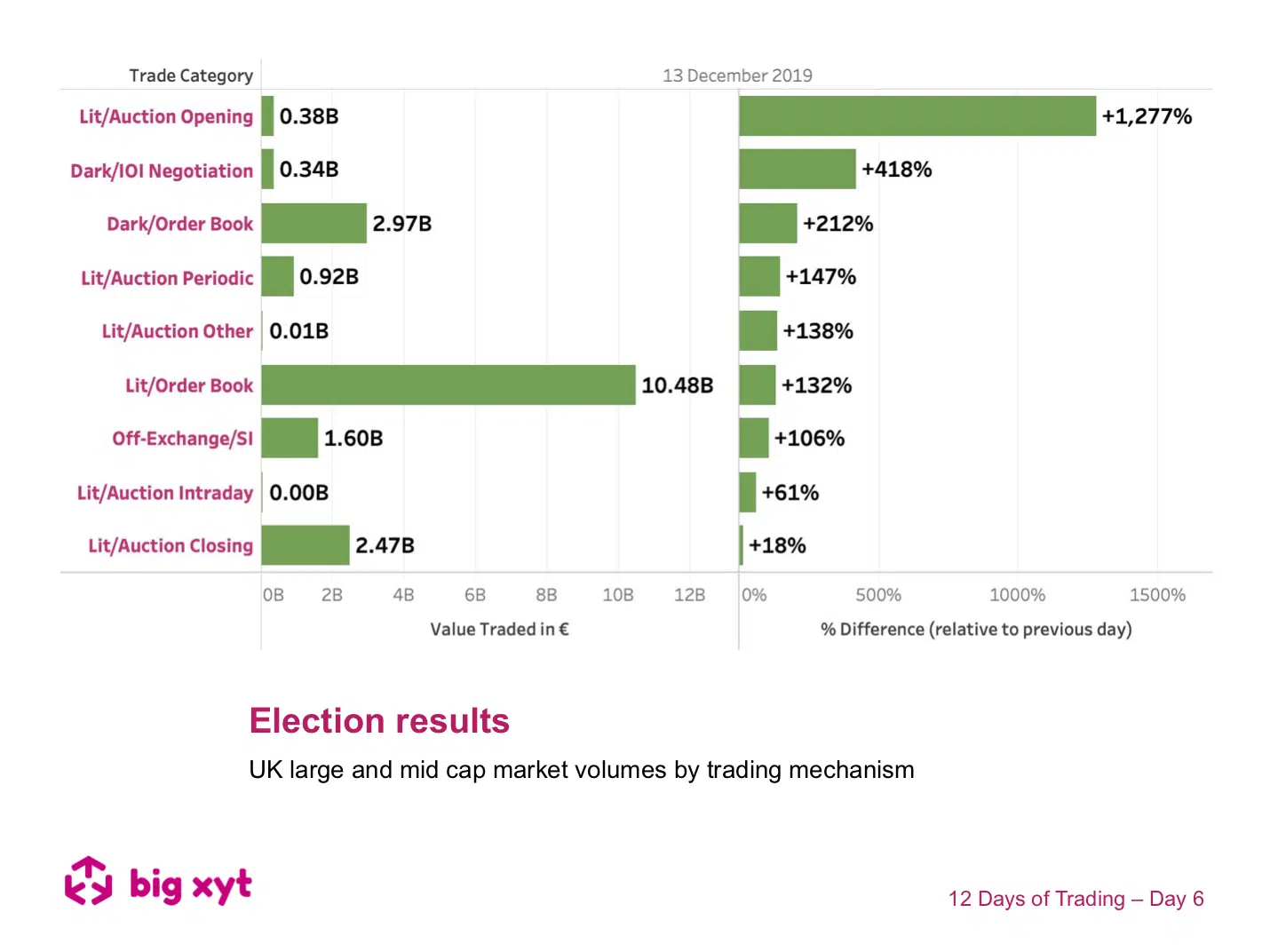

Day 6 of 12: Election Results – UK large and mid cap market volumes by trading mechanism

The impact of the results of the UK General Election on market volumes was dramatic, with UK volumes more than doubling. We looked more closely at how the underlying venues and mechanisms benefitted in relative terms.

The left hand side of the chart shows the volumes traded on Friday by mechanism. The right hand side shows the percentage increase by mechanism compared to the previous day. Market participants needed to react quickly to position themselves.

This can be clearly seen with the opening auction having the greatest change relative to the previous day. Second were the Large In Scale and dark venues. Under these conditions, different strategies are necessary for speed of implementation and access to significant blocks of liquidity.

The mechanism least affected was the closing auction. This raises interesting questions about what has driven the growing popularity of the Closing Auctions at the expense of the rest of the trading day.

Liquidity Cockpit users are able to look at any stock this way and see the venues broken down. Clients using our Execution Analysis/TCA are able to measure execution performance with the demonstrated precision and flexibility.

—

Do you want to receive future updates directly via email? Use the following form to subscribe.

On our 12 Days of Trading

As the year draws to a close we have been asked by clients to repeat our festive exercise on the 12 days leading up to the holidays. As a result, you will find a post to a different 2019 big-xyt observation each day. We look and highlight trends since the introduction of MiFID II with a focus on this year’s changes or events.

We hope you enjoy them.

—

This content has been created using the Liquidity Cockpit API.

About the Liquidity Cockpit

At big-xyt we take great pride in providing solutions to the complex challenges of data analysis. Navigating in fragmented markets remains a challenge for all participants. We recognise that the investing community needs and expects continued innovation as the volume of data and related complexity continues to increase.

Our Liquidity Cockpit is now recognised as an essential independent tool for exchanges, Sell-side and increasingly Buy-side market participants. Data quality is a key component, as is a robust process for normalisation so that like-for-like comparisons and trends over time have relevance. However, our clients most value a choice of flexible delivery methods which can be via interactive dashboard or direct access to underlying data and analysis through CSV, API or other appropriate mechanism.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.