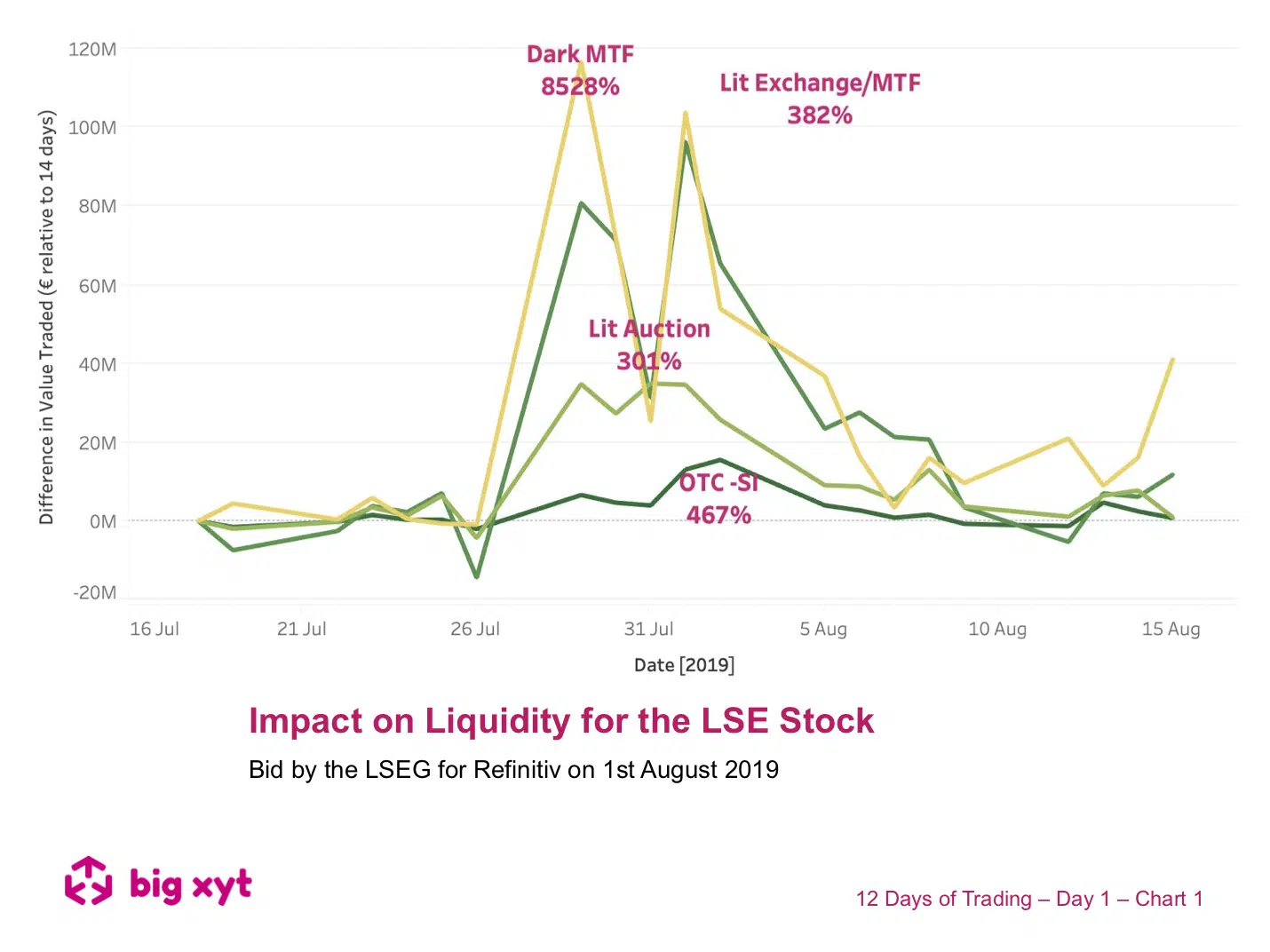

Liquidity on lit order books is driven by pre-trade transparency. Therefore, tighter spreads or deeper visible liquidity can lead to market share growth on one venue at the expense of another. Alternative mechanisms also play their part in particular circumstances. Take the example here where major news on two occasions throughout the year caused a basis change in the price of the London Stock Exchange Group (ironically the owner of three major European Equity venues). Traders noting a new price level wanted to trade and trade in size. With the news leading, to increased activity, the fragmentation of liquidity changed in a somewhat unexpected way. Market Share in lit books and block volumes increased dramatically compared to other mechanisms. Of further note was that this increase persisted in block venues, not just for the duration of the day of the announcement but for subsequent days until matched block liquidity was exhausted at that price level.

Take a look at the profile of a different LSE event in August in the first chart. Here we see the liquidity profile of the bidder rather than as the target. In the second chart, the tables are turned. How significant are the volume changes before as well as after the announcement?

I recall one of the first pieces of old market advice I received “Buy on the rumour. Sell on the news.”

If you have found these pieces of analysis useful you will find there is a lot more you can do with our Liquidity Cockpit.

On our 12 Days of Trading

As the year draws to a close we have been asked by clients to repeat our festive exercise on the 12 days leading up to the holidays. As a result, you will find a post to a different 2019 big-xyt observation each day. We look and highlight trends since the introduction of MiFID II with a focus on this year’s changes or events.

We hope you enjoy them.

—

This content has been created using the Liquidity Cockpit API.

About the Liquidity Cockpit

At big-xyt we take great pride in providing solutions to the complex challenges of data analysis. Navigating in fragmented markets remains a challenge for all participants. We recognise that the investing community needs and expects continued innovation as the volume of data and related complexity continues to increase.

Our Liquidity Cockpit is now recognised as an essential independent tool for exchanges, Sell-side and increasingly Buy-side market participants. Data quality is a key component, as is a robust process for normalisation so that like-for-like comparisons and trends over time have relevance. However, our clients most value a choice of flexible delivery methods which can be via interactive dashboard or direct access to underlying data and analysis through CSV, API or other appropriate mechanism.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.