The markets responded with the usual enthusiasm for major news yesterday with the announcement of Jenny Chen joining our team to extend our reach in the US market. In other news, we saw a likely result in the US presidential election and word of a vaccine.

As with Q1, the stories precipitated dramatic increases in traded volumes, price volatility and sector rotation. But did you allow for the same changes in market conditions when trading?

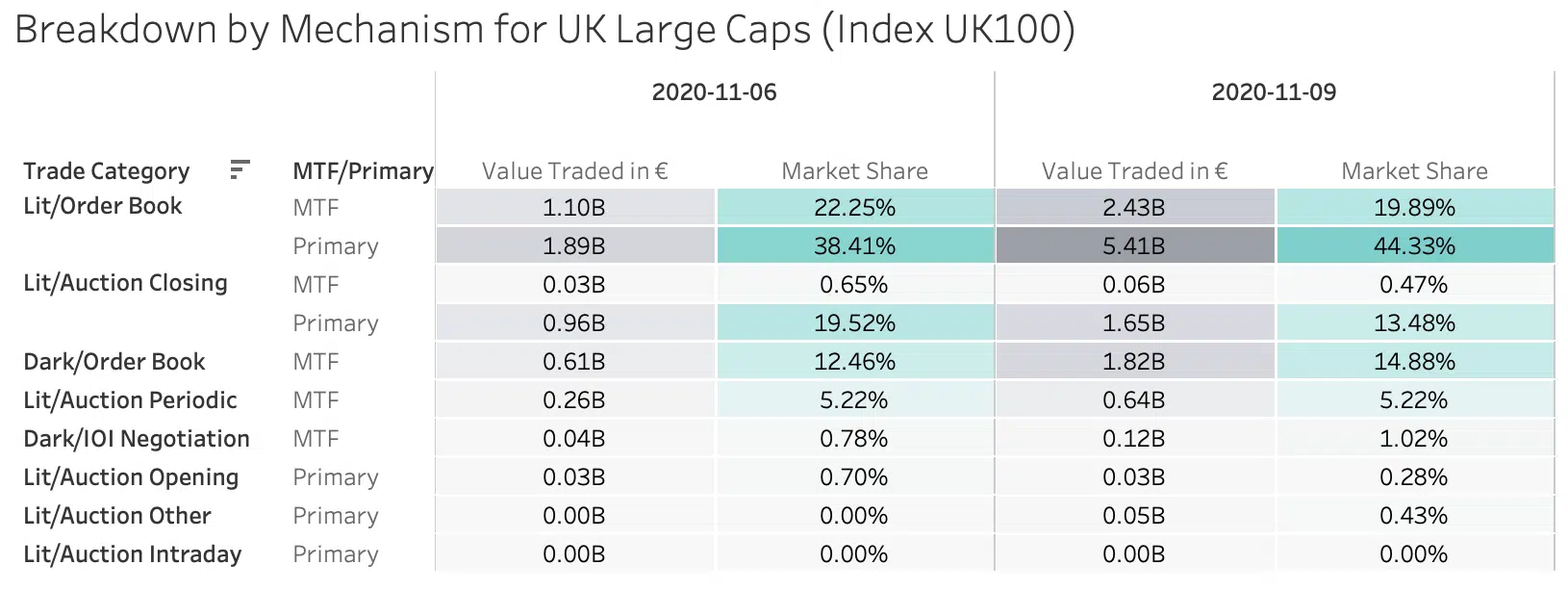

Let’s take the example of UK blue chips:

- Average (time weighted) spreads were 46% wider

- Average available depth at touch was reduced by 24%

Combine those increased costs of each aggressive execution with the change to the norm in observed activity on different mechanisms (Lit, Close, Periodics, Dark) in the table below and it could have been a more expensive day than you realise.

If data is the new oil, who do you trust with the refining?