Spruce up your critical Level Tree data points – a checklist fir optimised installation:

- Stand the tree overnight, freeing the branches to settle.

- There should be water in the base (ideally one that has four clamps for the bottom of the trunk).

- Once the tree has settled these clamps must be tightened gently and sequentially to ensure that the main body of the tree from top to bottom appears perpendicular to the horizontal from all viewing angles.

- You may want to use a spirit level or plumb line to confirm some angles and distances here – this is where level tree data can come into its own.

- Repeat stage 3 and 4 if adjustments are necessary.

- Only then can the lights be put on.

- And the decorations added.

Now you can stand back and admire your level tree.

In the world of big xyt, Level 3 data has many applications and is particularly important for our xyt Lab for research when looking in more depth at specific order book scenarios. If you have finished your Christmas shopping and are twiddling your thumbs before your guests arrive, here are a couple of examples of what is possible:

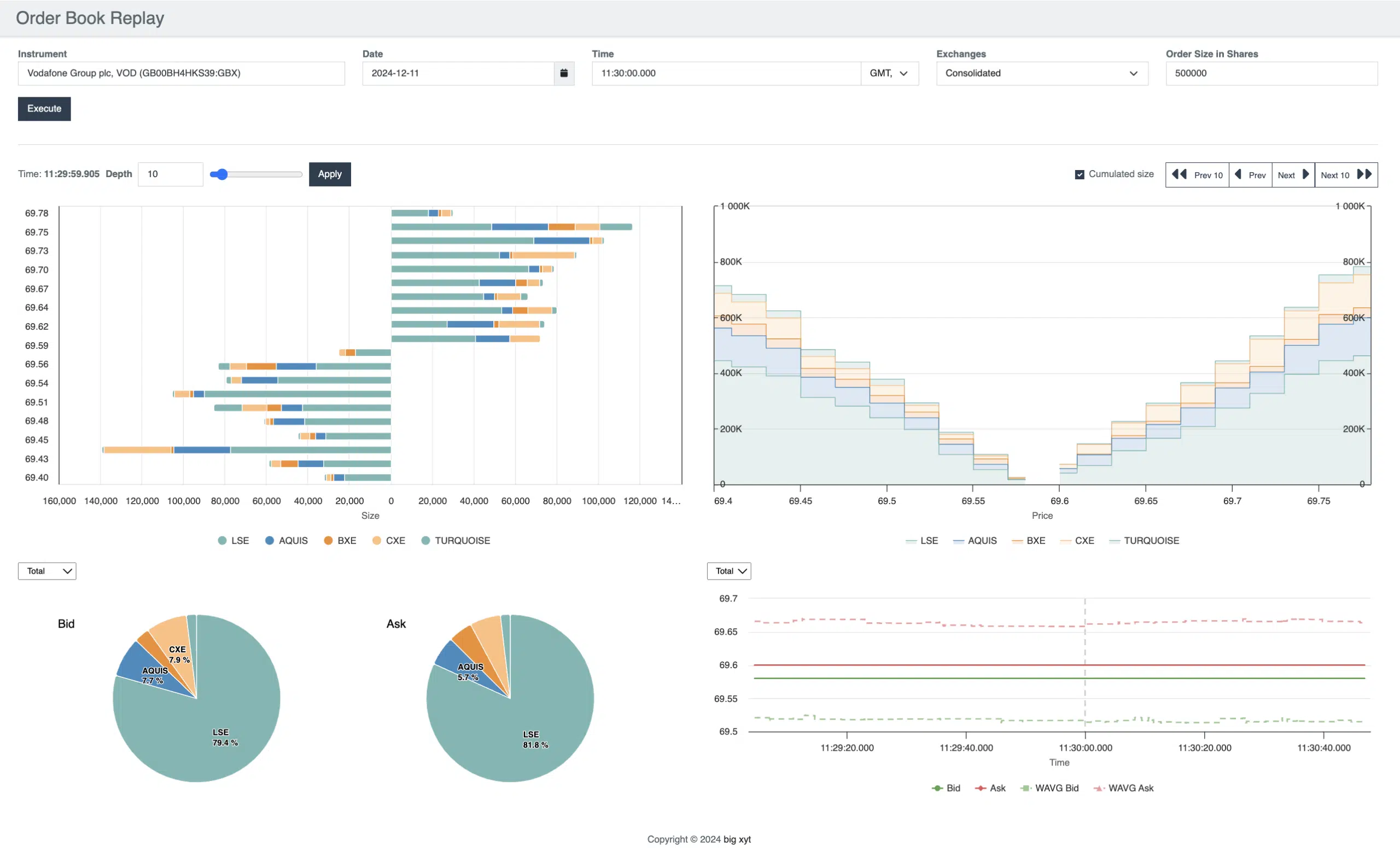

In our first example of order book replay we recreate the full order book at a single point in time across all venues where an instrument is quoted. The curious user can then play the book forward or backwards in time or submit an order to see how the spread is affected at that price.

Chart 1 – Order Book Replay

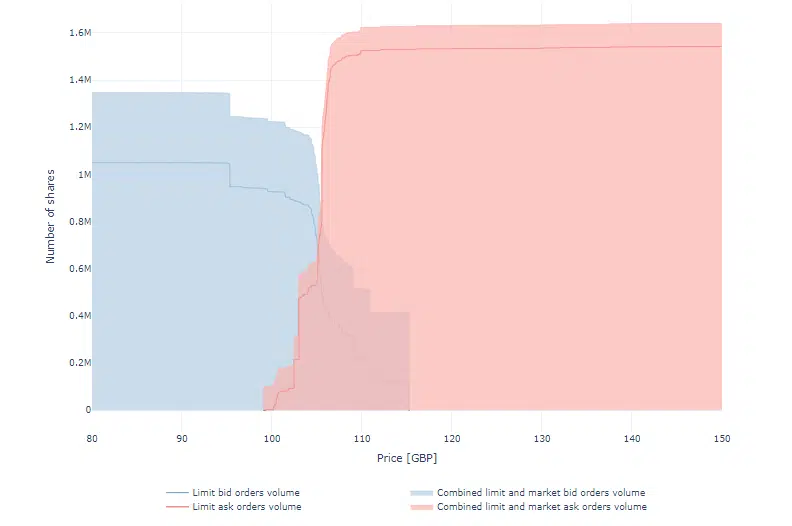

The way we use level 3 data here is to view the building of the order book throughout the closing auction including the contribution of limit and market orders. We can then simulate the impact on price and uncrossing size when additional orders are added to the auction.

Chart 2 – Auction Order Book Detail

Our xyt Lab environment is designed as a convenient platform for research using the most granular data, with the benefit of our recognised approach to consistent normalisation and data cleansing. However if you prefer to see the results produced through charts or tables, our own research team can produce dynamic visualisations for business users.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.