Christmas is a season full of surprises, and the European ETF market is offering its own unexpected gift this year – a shift in trading dynamics that few might have anticipated.

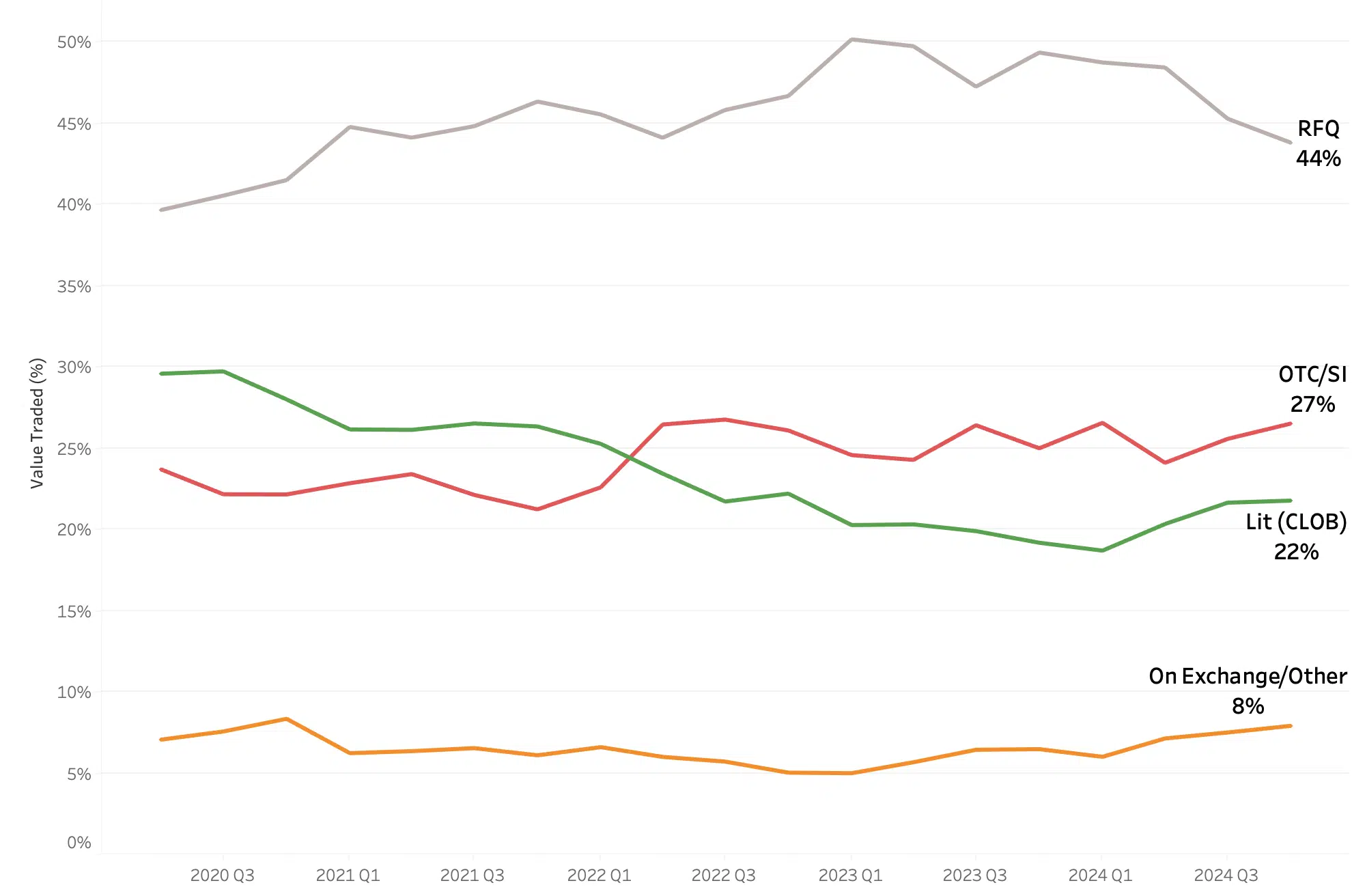

For years, the market structure seemed to follow a steady, predictable trend. RFQ platforms dominated trading, holding a commanding 50% share across all products, venues, and mechanisms. But as we unwrapped the final quarter of 2023, the winds of change began to blow. RFQ’s dominance is now contracting, making room for other mechanisms to gain ground.

Lit markets, OTC/SIs, and off-book/on-exchange trades are all seeing their share grow. Remarkably, this trend remains true even when excluding the activity on German regional exchanges, suggesting it’s not just a localised phenomenon.

What’s driving this shift? Like the excitement of discovering a surprise gift under the tree, the answers are still unfolding. Could it be the rise in retail flow, fueled by new investors entering the market? Perhaps it’s the growing adoption of execution algorithms, offering traders more sophisticated options to navigate a changing landscape.

As we look ahead to the new year, the question remains: will this change gain momentum? Just like the anticipation of Christmas morning, the ETF market in 2024 promises plenty of excitement as we uncover the forces shaping its future.

For now, let’s take a moment to enjoy the surprises that keep the market vibrant. Wishing you a joyful holiday season filled with unexpected opportunities and a bright start to the new year!

****

All the content here has been generated by big xyt’s Liquidity Cockpit for ETFs dashboards or API.

For existing clients – Log in to the Liquidity Cockpit for ETFs.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit for ETFs.