You really should sell, you’d better not buy, you ought to be short, I’m telling you why,

VWAP Crossing’s coming to town.

He’s trading a list, she’s rolling the dice, they’ll spread it out so the impact is nice.

VWAP Crossing’s coming to town.

They see the prices creeping, they’ve got a data lake.

They’ve done the calculations – they’d better be right for goodness sake.

Is the benchmark even right for the fundholders’ sake?

Never mind that, get the order despatched.

Oh no, which provider is better at a trajectory match?

VWAP Crossing’s coming to town!

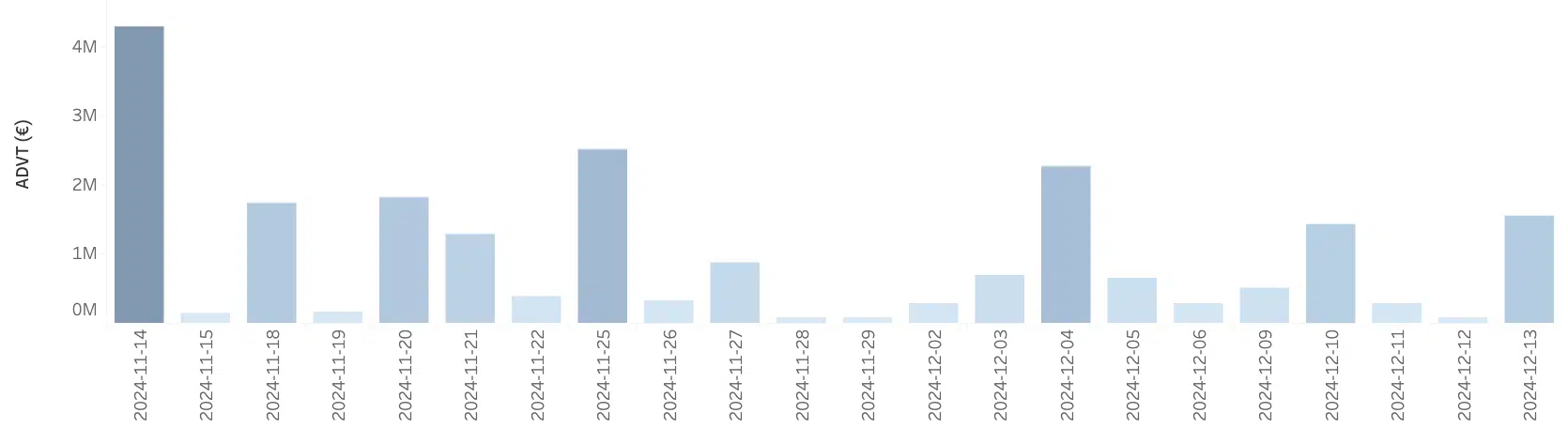

When new mechanisms are introduced it is vitally important that the community has the transparency to observe any volume trends and the most relevant market quality metrics to assess the attractiveness, benefits and success of the new venue.

Liquidity Cockpit tracking of recently introduced VWAP X volumes

The choices for investors have never been broader. Aquis, Cboe, Intelligent Cross, Investec, One Chronos, OptimX, Purestream and others are all innovating to provide alternatives to the growing trend towards direct capital access. In addition, retail flow is increasingly mentioned as a consideration. This choice presents challenges for the end investment managers with large institutional orders. Who and how do I choose? We have some ideas about how you can do that.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.