As the holiday season lights up the markets, there’s one star on the ETF tree that deserves special attention: the European Best Bid and Offer (EBBO). For investors navigating the thousands of ETF listings across Europe, EBBO is like the guiding star that leads to smarter decisions and potentially better outcomes.

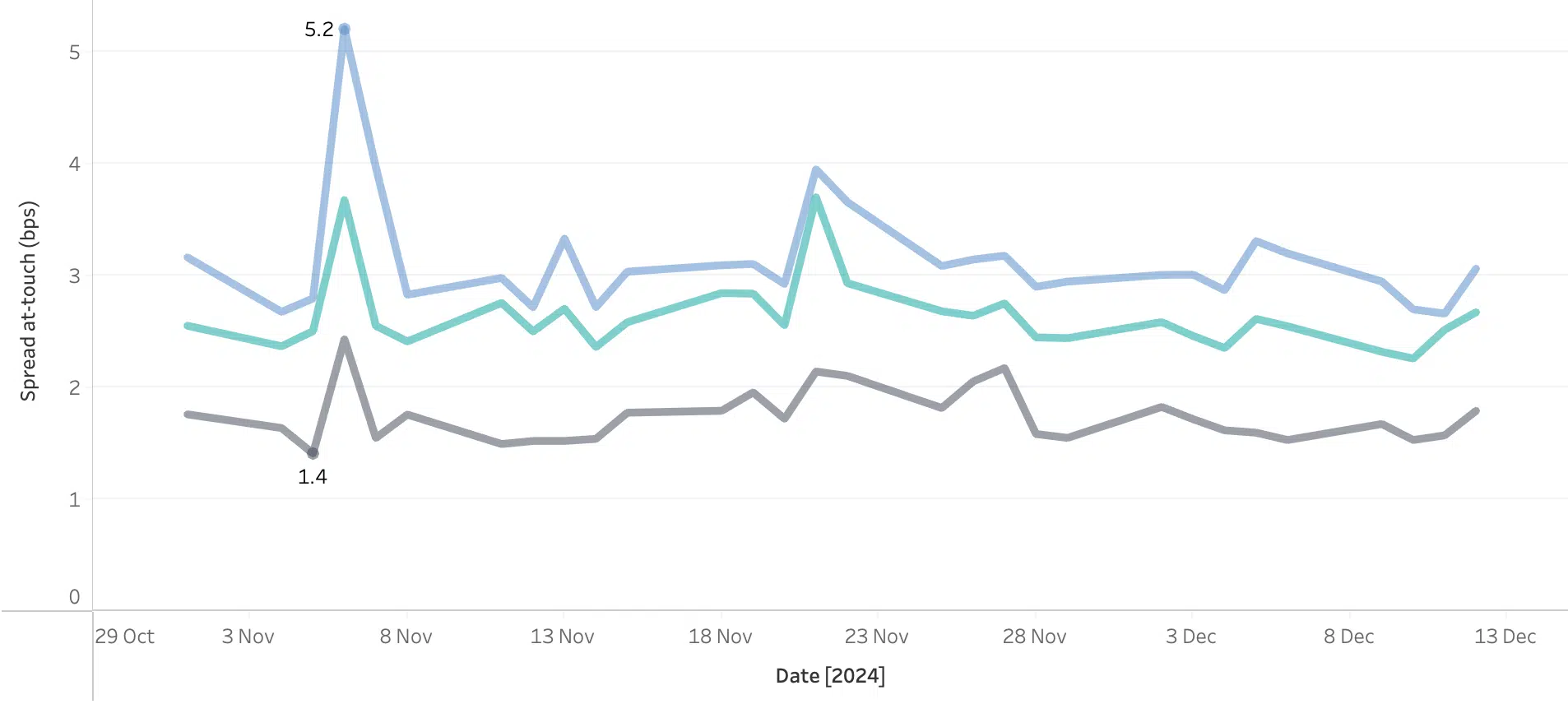

When selecting or trading ETFs, spreads are the gift that keeps on giving – a key indicator of market quality and execution costs. But unwrapping this data isn’t always straightforward. Spreads can vary significantly across venues, shifting throughout the trading day like snowflakes in the wind. Finding the venue and listing with the tightest spread can feel like searching for the perfect present amid a mountain of choices.

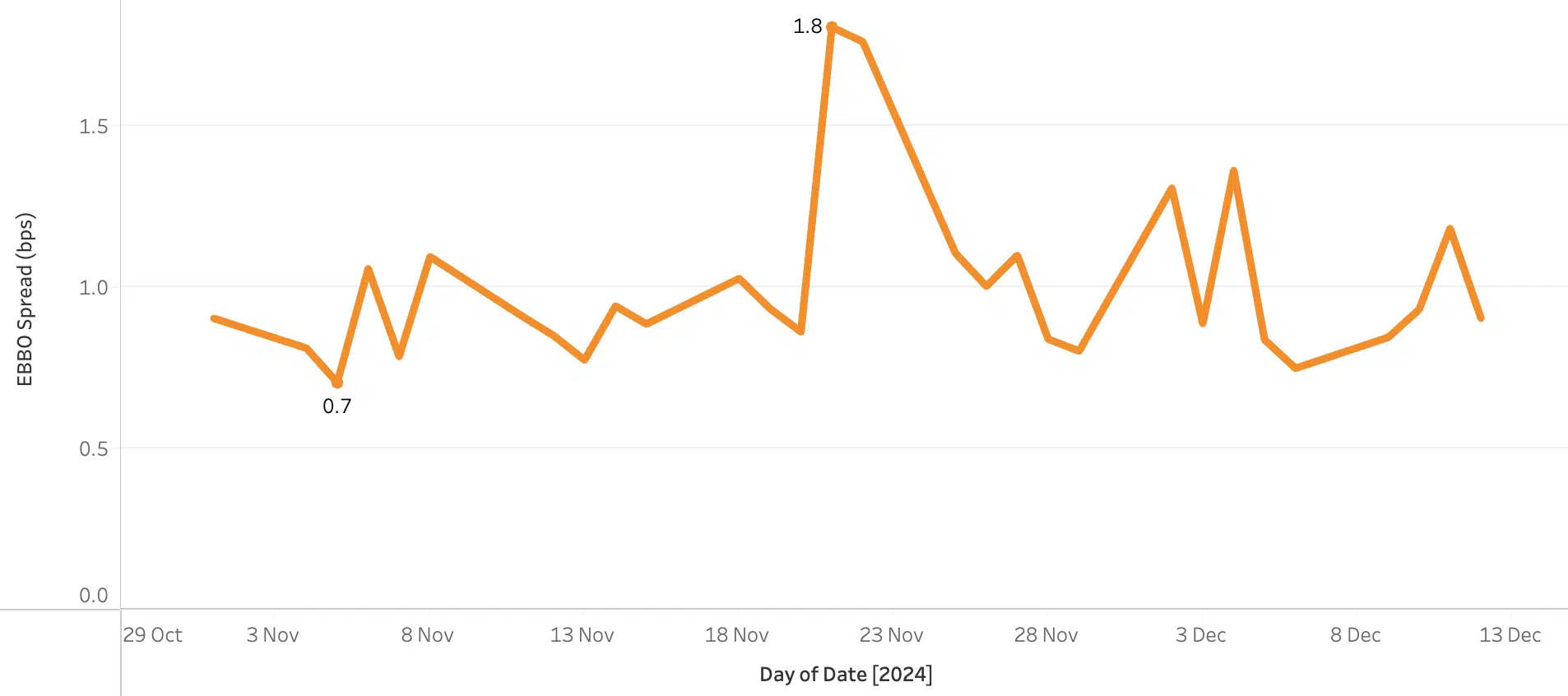

Here’s where the EBBO steps in to deliver a festive surprise. By looking at the combined liquidity across all listings, the EBBO spread often proves significantly tighter than the best listing. Think of it as the ultimate holiday bundle – greater liquidity, more attractive prices, and a clearer picture of the market.

Chart 1: Spreads of a given ETF across all main exchanges. The tightest spread being around 2bps.

Chart 2: EBBO spread of the same ETF (and currency) showing a much tighter spread (approx. 1 bps on average).

This is a win for both investors and issuers. Investors gain insights to refine their strategies and reduce costs, while issuers can highlight the enhanced liquidity of their products. And while trading algorithms aren’t yet the go-to method for ETFs, the EBBO hints at opportunities for price improvement that are worth exploring.

As the industry eagerly awaits the arrival of a consolidated tape, tools to analyse consolidated liquidity are already here. With big xyt’s solutions, investors, issuers, and brokers have access to the insights they need to make informed decisions today.

This holiday season, let’s celebrate the gift of EBBO: a brighter, clearer path through the growing ETF market. May your spreads be tight, your liquidity deep, and your trading results merry and bright!

****

All the content here has been generated by big xyt’s Liquidity Cockpit for ETFs dashboards or API.

For existing clients – Log in to the Liquidity Cockpit for ETFs.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit for ETFs.