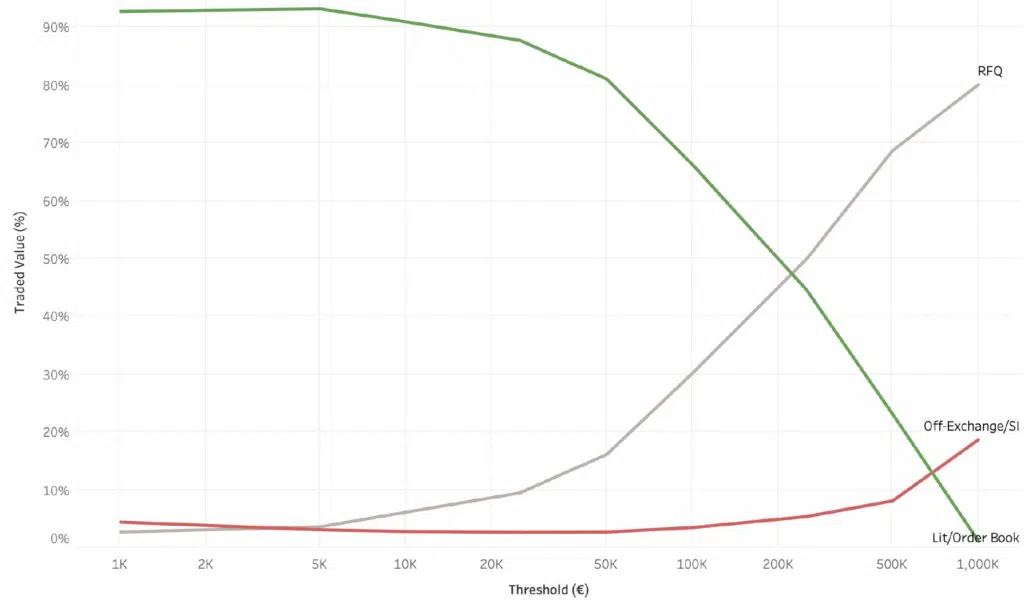

Exploring the Christmas market of ETFs in Europe is like unwrapping presents – trade sizes above €1m do the tango on RFQ platforms (80%) and OTC (20%), while the smaller ones jingle all the way on exchanges.

For trade sizes around €200k, RFQs and exchanges share the mistletoe evenly. But, watch out for those Systematic Internalisers sneaking into the holiday party for sizes under €5k – they’ve got a 5% market share, like elves in the market workshop!

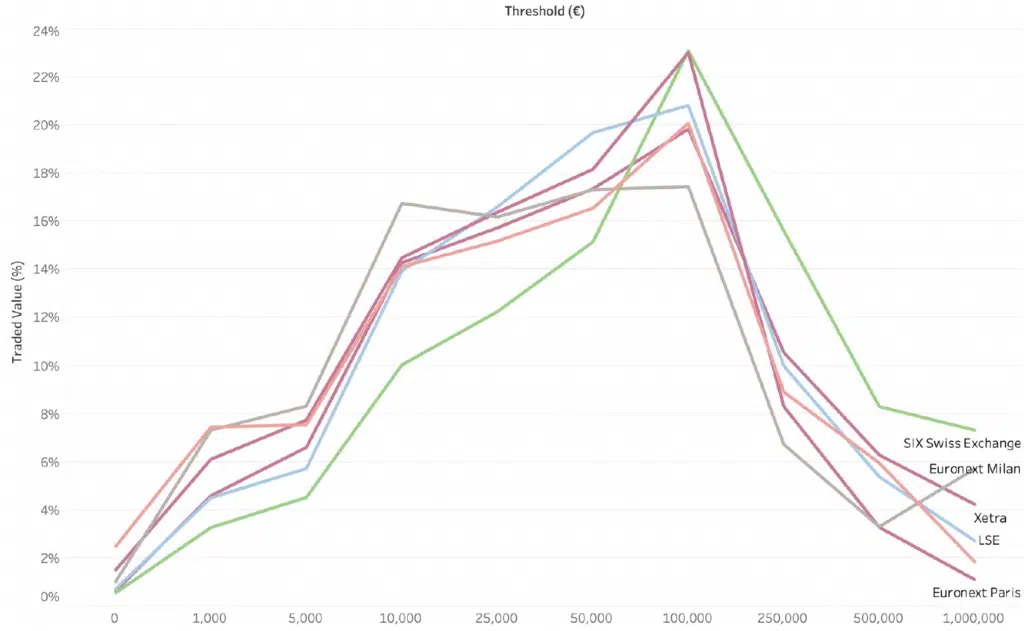

Only 20% of ETF volumes dance on central limit order books, but fear not, investors can deck the halls of multiple exchanges. Unwrapping the market share by exchange reveals a festive surprise – it’s like each exchange got the same Christmas wishlist, especially at the magical €100k sweet spot.

As the market structure transforms like a snowflake, expect participants to challenge the trading status quo with innovative sleigh rides. Some may dash through the snow first, but soon, others will follow in a winter wonderland of ETF trading!

Market share by mechanism and trade size for European ETFs

ETF market share by trade size for major European exchanges

****

All the content here has been generated by big xyt’s Liquidity Cockpit for ETFs dashboards or API.

For existing clients – Log in to the Liquidity Cockpit for ETFs.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit for ETFs.