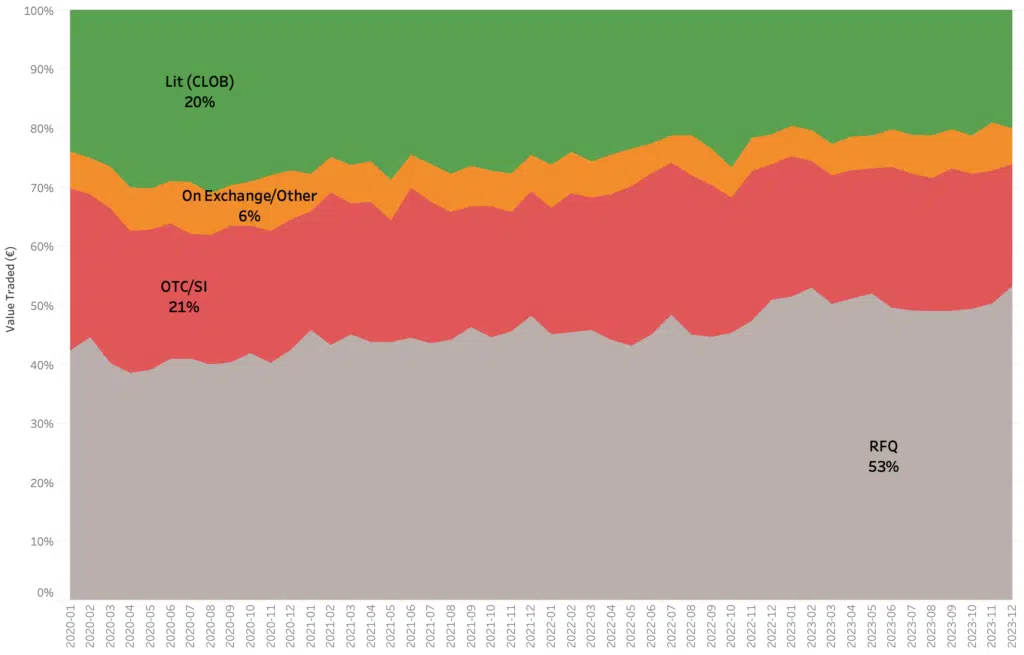

‘Tis the season to be jolly, especially in the ever-evolving world of European ETFs! Did you know that more than 50% of the holiday cheer – we mean, trading volume – is now groovin’ through RFQ platforms? It’s like the dance floor at the office Christmas party, everyone’s got their moves, and RFQs seem to be leading the conga line.

Now, some say the ETF industry is throwing a festive shindig and is pretty content with the current status quo. It’s like finding the perfect Christmas sweater – it just fits, and everyone’s rocking it. Many even predict that RFQs will continue to be the life of the party, providing merry advantages to market makers and investors alike.

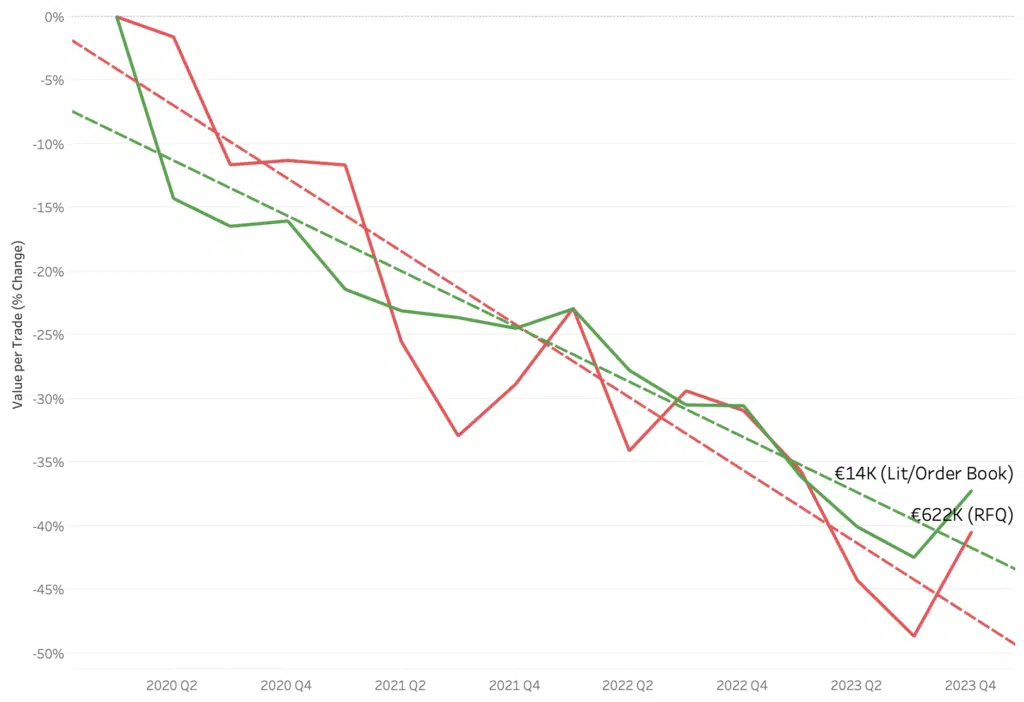

But wait, there’s a plot twist in this yuletide tale! The market structure for ETFs is doing its own version of the Nutcracker ballet – graceful, yet full of surprises. Brace yourself for the impact, as the past few years have seen the average notional traded steadily shrink, like Santa down a chimney on a diet. Picture this: a whopping 50% reduction in the past four years. That’s right – it’s like Rudolph suddenly switching to a compact sleigh.

So, as we raise our glasses of eggnog and toast to the uniqueness of European ETF market structure, let’s keep an eye out for the evolving dance moves that might shape the future of ETF trading. It’s a dynamic snow globe out there, and change is as inevitable as fruitcake during the holidays…

Chart 1 – Market Share by Mechanism for all European ETPs (since Jan 2020)

Chart 2 – Change of Average Trade Size for CLOB and RFQ Venues (since Jan 2020)

****

All the content here has been generated by big xyt’s Liquidity Cockpit for ETFs dashboards or API.

For existing clients – Log in to the Liquidity Cockpit for ETFs.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit for ETFs.