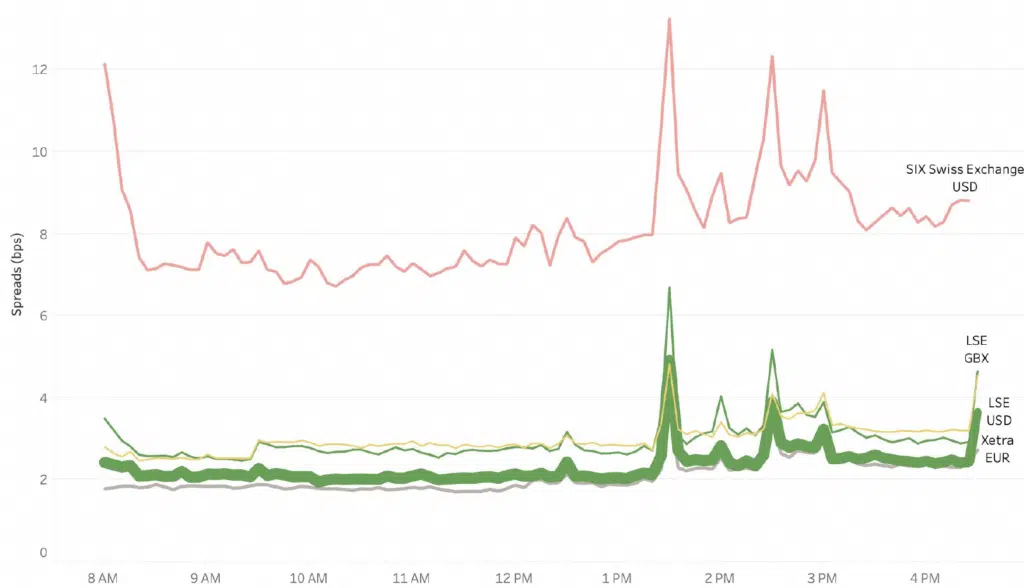

‘Tis the season to unwrap the mysteries of European ETF liquidity with a sprinkle of festive humour! Move over, sugarplums – let’s talk about spreads and get into the holiday ETF spirit. Imagine ETF spreads taking centre stage during the US open, putting on a show that even Santa would envy. It’s like a Wall Street celebration, but with spreads leading the way!

And who could forget the star of the show? The tracker of a US basket takes the spotlight, flaunting wider spreads as if it’s the life of the financial party. It’s like watching the cash market and the ETF navigate the holiday hustle together.

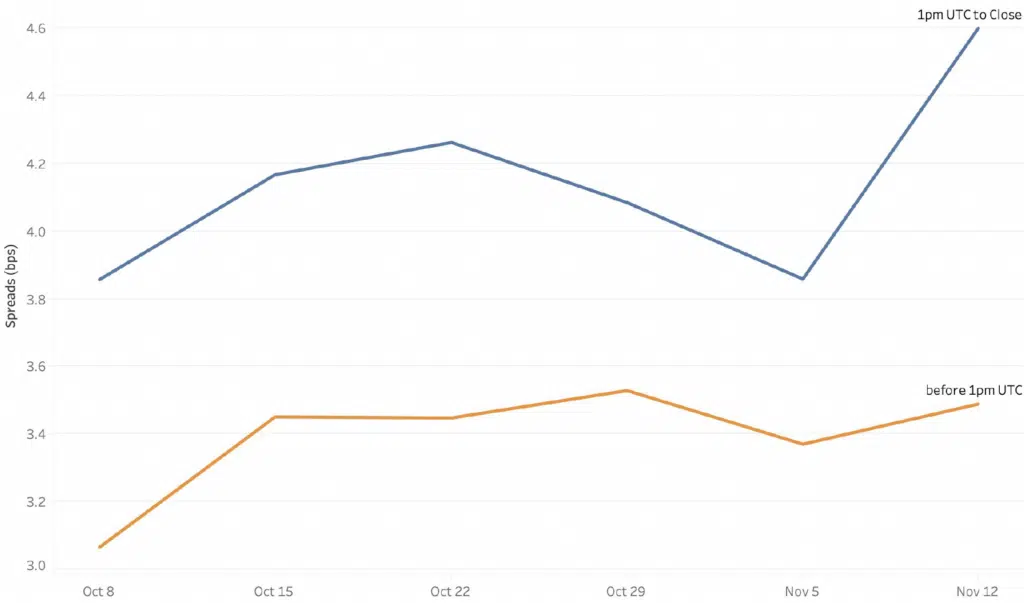

This jolly observation isn’t a one-hit wonder; it’s a gift that keeps on giving across different ETFs and issuers. It’s as consistent as finding wider spreads in the afternoon – just like the joy of opening presents on Christmas Day.

Issuers, grab your financial mistletoe! Properly monitoring spreads isn’t just the stuff(ing) of dreams; it’s the key to guiding investors and sparking in-depth conversations with market makers and exchanges. So, as you analyse those liquidity spreads, may your spreadsheets be merry, and your insights be as bright as Rudolph’s nose!

Intraday spreads of an ETF and its listings (US tracker)

Spreads in the afternoon approx. 1 bps higher compared to the morning hours (US tracker)

****

All the content here has been generated by big xyt’s Liquidity Cockpit for ETFs dashboards or API.

For existing clients – Log in to the Liquidity Cockpit for ETFs.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit for ETFs.