The Christmas stocking is still a major part of any family Christmas. It’s the perfect place to find last minute surprises like satsumas, bottles of gin, or a multi-rotor copter drone. You never know what you might find, sometimes you get lucky and sometimes you don’t, and then of course there is the sweet smell of hessian. In fact, they are a lot like dark pools, apart from the hessian.

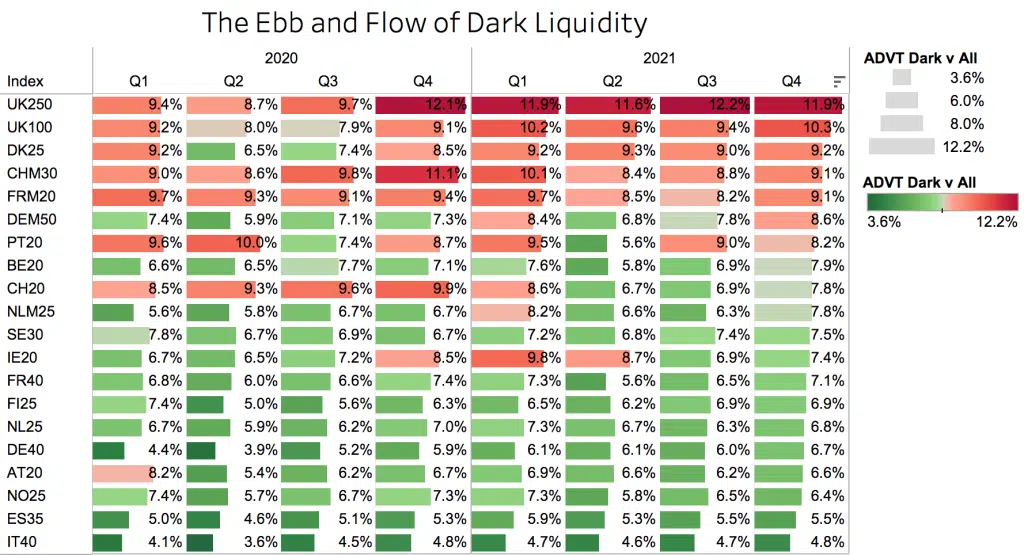

In our post about block trades on Day 2 of the 12 Days of Trading, we looked at block trading in dark pools, and today we examine the broader trend, post-Brexit. In Q4 2020 when the FCA announced that they would stop enforcing the dark volume cap mechanism, UK dark trading promptly increased. The mid cap names accelerated by over 50% and stabilised at 12% of daily value, with the UK100 index not far behind at 10% (see Chart 1).

Chart 1

Whilst a clear pattern was forming in the UK, there was also a 10% increase in dark trading in EU countries and a 16% reduction in Switzerland. During the loss of Swiss equivalence, dark pool trading increased due to a transfer of activity from off-market block trades and systematic internalisation which was reversed this year when equivalence was restored.

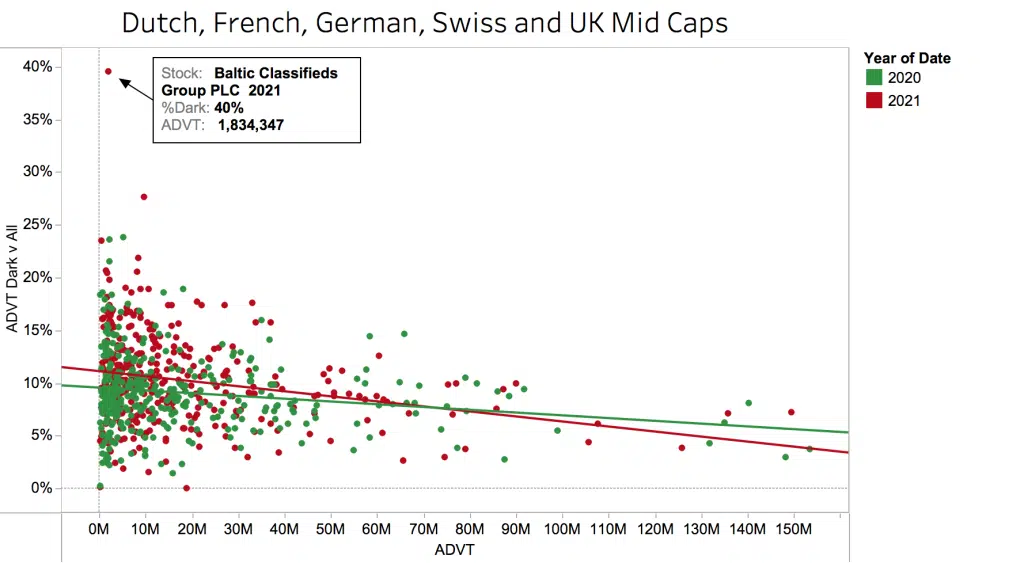

Overall, Roche AG was the most traded stock in dark pools this year, with €53M per day and a rate of 7.7%. In relative terms, the winner is the UK250 name Baltic Classifieds at 41% of ADV. 24 of the UK100 index now trade above 13% in the dark, with newly floated Deliveroo running ahead at 21%. Amongst a clutch of Dutch IPOs in 2021, chart-topper Universal Music has traded 13% per day in the dark since its launch in September as it has yet to go through a 12-month review for dark cap eligibility.

Chart 2

Chart 3

As seen in Chart 2, mid-caps everywhere tend to have a higher dark trading ratio than their more liquid counterparts, for example, in the UK, Swiss, French and German mid-level indexes. When we look in more detail for a reliable pattern in the ratio of dark trading (Chart 3), we can see that while higher turnover names tend to trade less in the dark, there is not much of a pattern in low turnover names.

There is certainly a mixture of factors behind this, including the randomness of finding blocks (that give a temporarily heavy weighting to the dark pools), and the ebb and flow action of the DVC mechanism that temporarily removes smaller trades for six-month periods.

It seems every stock has its own story which underlines the importance of reliable, daily, stock level data, which you can easily find in our Liquidity Cockpit.

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.