In the good old days, your Christmas tipple might have been a gin & tonic, of which there were few mainstream choices for the spirit or the mixer. Then, almost overnight, there was a somewhat confusing abundance of choice for both, garnished with the decision of what variety of fruit or vegetable should be sliced into it.

Something similar has happened to the means by which traders target that increasingly popular benchmark – the Official Close. There was a time when all you had to do was send the order to the primary exchange during the closing auction and then sit back with the aforementioned “large Vera, Supersonic with two white mice,” but now there is so much choice…

We first commented in a post on Alternative Closing Mechanisms in December 2019.

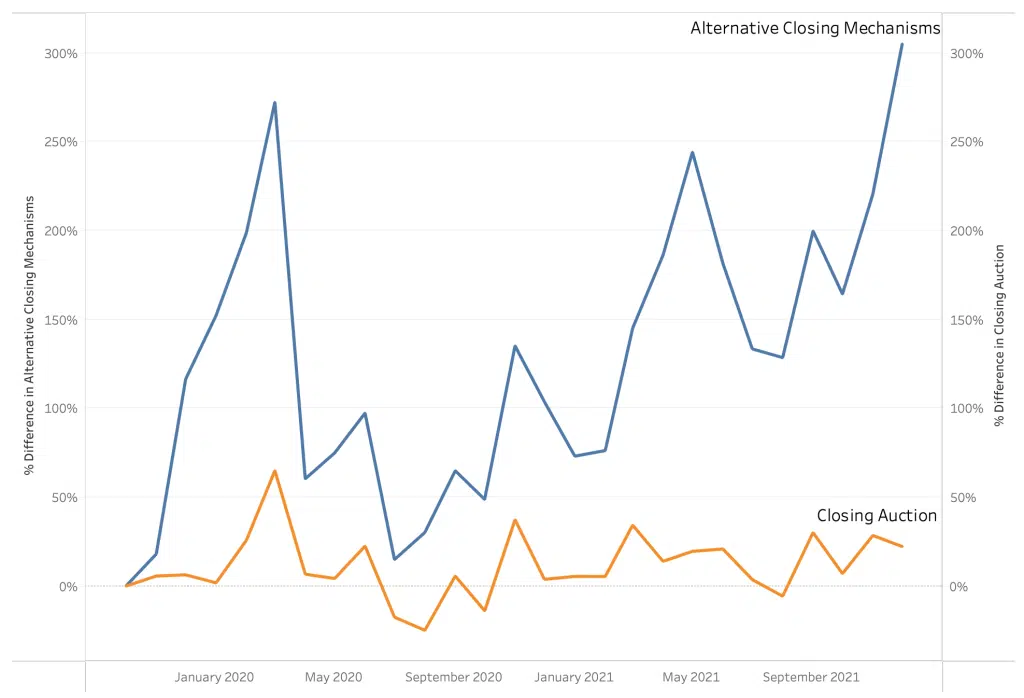

Over the last two years European Closing Auction volumes are up 23%, as revealed in more detail in our first post of this year’s 12 Days of Trading.

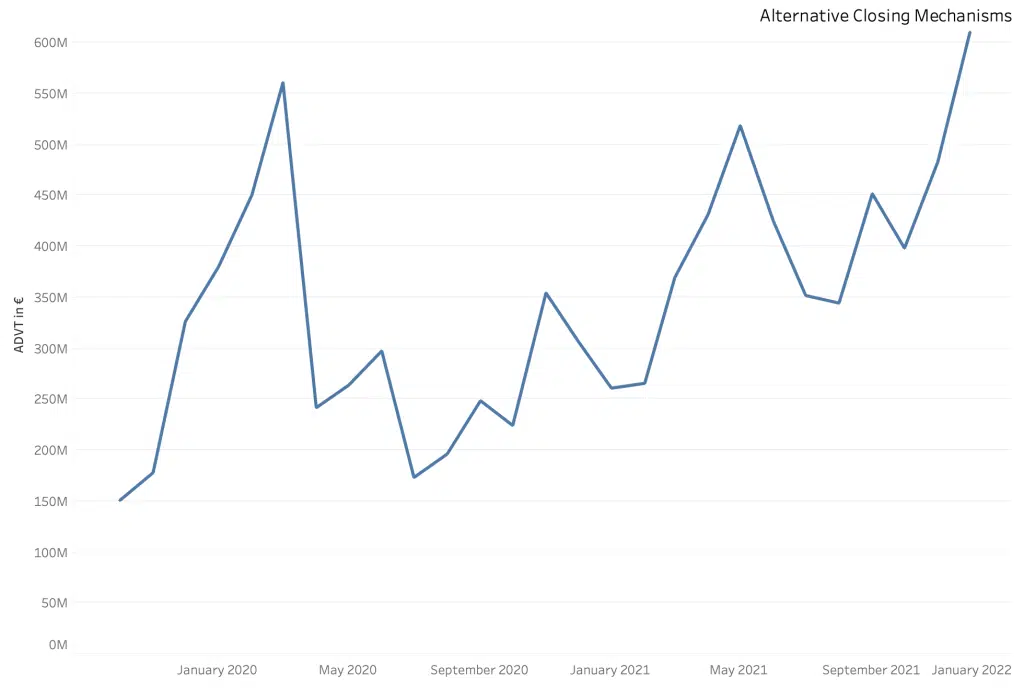

In the same period, Alternative Closing Mechanisms value traded has increased three-fold. Chart 1 shows Average Daily Value Traded through Alternative Closing Mechanisms.

Admittedly, starting from a low base, this activity now represents 4.5-5 % of total closing auction activity. This indicates somewhat that whilst the focus on the close as a trading benchmark continues to increase, alternative ways to capture that benchmark are developing. More venues have been providing a means to achieve the benchmark (see our Liquidity Cockpit for a detailed breakdown by venue or stock over time). Chart 2 shows Comparative 2 year growth of primary versus alternative closing mechanisms.

The reasons behind these alternatives could be cost related or a desire to reduce information leakage, but there is no doubt that the trend is growing. This is all against a backdrop of exchange traded volumes that have been stable for some time. Further to this we have also observed that trades are being reported after the market close, at the closing price, but away from the primary markets and MTFs. If our suspicions are correct, these may represent other intermediaries offering to mix a cocktail or two away from the usual licensed premises.

Will the regulators be shaken or stirred, we wonder?

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.