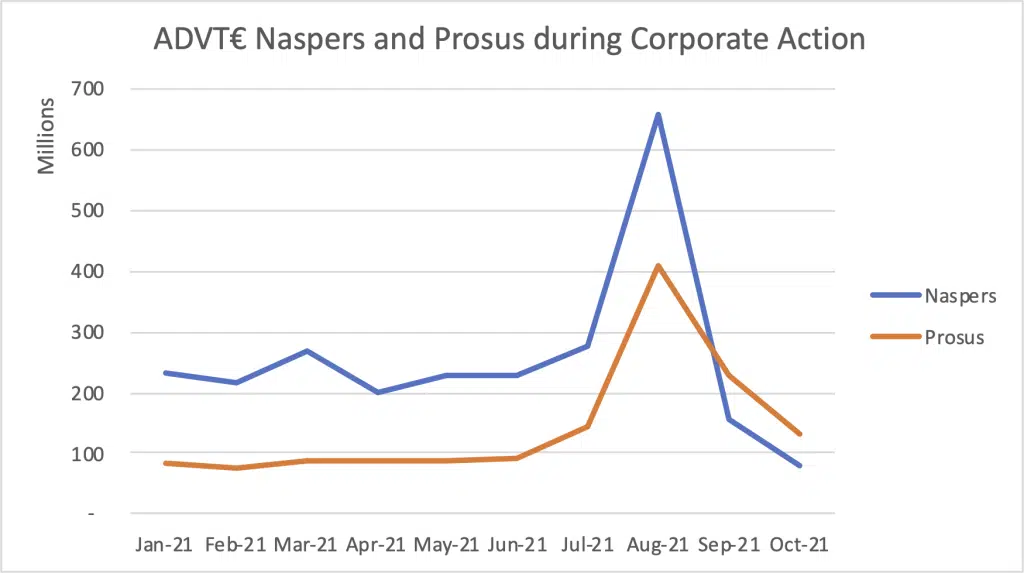

At big xyt, we like to think big. At Christmas there’s nothing like a big pile of presents under the tree on Christmas morning and the big parcels are often the least expected and the most surprising. It’s got us thinking about the biggest corporate events of the year. One in particular springs to mind which was the share swap between Naspers Ltd and its sister company, Prosus NV. Naspers was the most traded name on the Johannesburg Stock Exchange (also the home of the Huge Group by the way!) at around €250M per day, with Prosus in second spot with around €100M. Together, they are the top two names in the JSE’s SWIX index with about 20% share of overall market volumes.

Nasper’s management decided to reduce the concentration of their shares in the index (which was around 10%), by offering a swap for new Prosus shares. This was announced in May, and completed, oversubscribed in August. Trading in the two issues took off, with volumes almost tripling in Naspers to nearly €650M per day and more than quadrupling in Prosus. Together they helped set new records for the JSE which reached nearly €1.7B ADV in August, a jump of 39% from the 2021 average. The event met its objectives in terms of the index weights with Naspers, and Prosus has taken the Number 1 slot in terms of share of market volumes.

Meanwhile Prosus, which is also listed on Euronext Amsterdam, briefly knocked its neighbour ASML off the top slot to become the most traded stock in Europe at over €1B a day for the month of August, with a mighty €6.6B as the offer closed on August 17th. Prosus has helped the NL25 to take over from the Swiss top 20 as the fourth most traded European index in 2021 with a little help from their friends at Universal Music. Another big corporate action event, the world’s largest music group joined the rock (sic) market as its new listing hit the heights with nearly €2B in order book trades on the first day.

Corporate actions have a major impact on index, sector and single stock level statistics, which can also indicate connections between liquidity pools such as those we saw with the dual listed Prosus.

You can use our Liquidity Cockpit to uncover your own surprises…

****

All the content here has been generated by big xyt’s Liquidity Cockpit dashboards or API.

For existing clients – Log in to the Liquidity Cockpit.

For everyone else – Please use this link to register your interest in the Liquidity Cockpit.

Oh and one last thing: We’ve been nominated in the A-Team’s TradingTech Insight Awards Europe 2022, in the Best Transaction Cost Analysis (TCA) Tool and the Best Trading Analytics Platform categories. Please vote for us here.