Changing the way data is interrogated and benchmarks viewed London, Frankfurt, 23 April 2019. big xyt, an independent provider of high-volume smart data and data analytics, is pleased to announce that, following consultation with a number of clients, the big xyt analytics platform has been extended to include Transaction Cost Analysis (TCA). It is recognised that post-trade TCA is transitioning from just a compliance solution to being seen as a crucial business function and big xyt is transforming the traditional view of TCA with data science; applying advanced techniques to increase quality and deliver flexible consolidated data views. Whilst TCA benchmarking calculations have not radically changed over the years firms increasingly demand flexibility to benchmark in-house analytics with an independent market source, in a way that better fits their business requirements.

One of largest financial companies and a major provider of institutional banking, investment management and broker services. Long-standing experience of trading electronically in European equities, offering a market-leading suite of algo execution and analysis tools to its clients. The Challenge Although the client was already using a white-labelled transaction cost analysis (TCA) service from another vendor, as a highly sophisticated user of TCA data and analytics, the client required a more detailed understanding of its execution performance than its existing provider was able to deliver. Critically, the incumbent vendor was unable to provide the required levels of transparency on the underlying data and methodology used to generate its TCA reports.

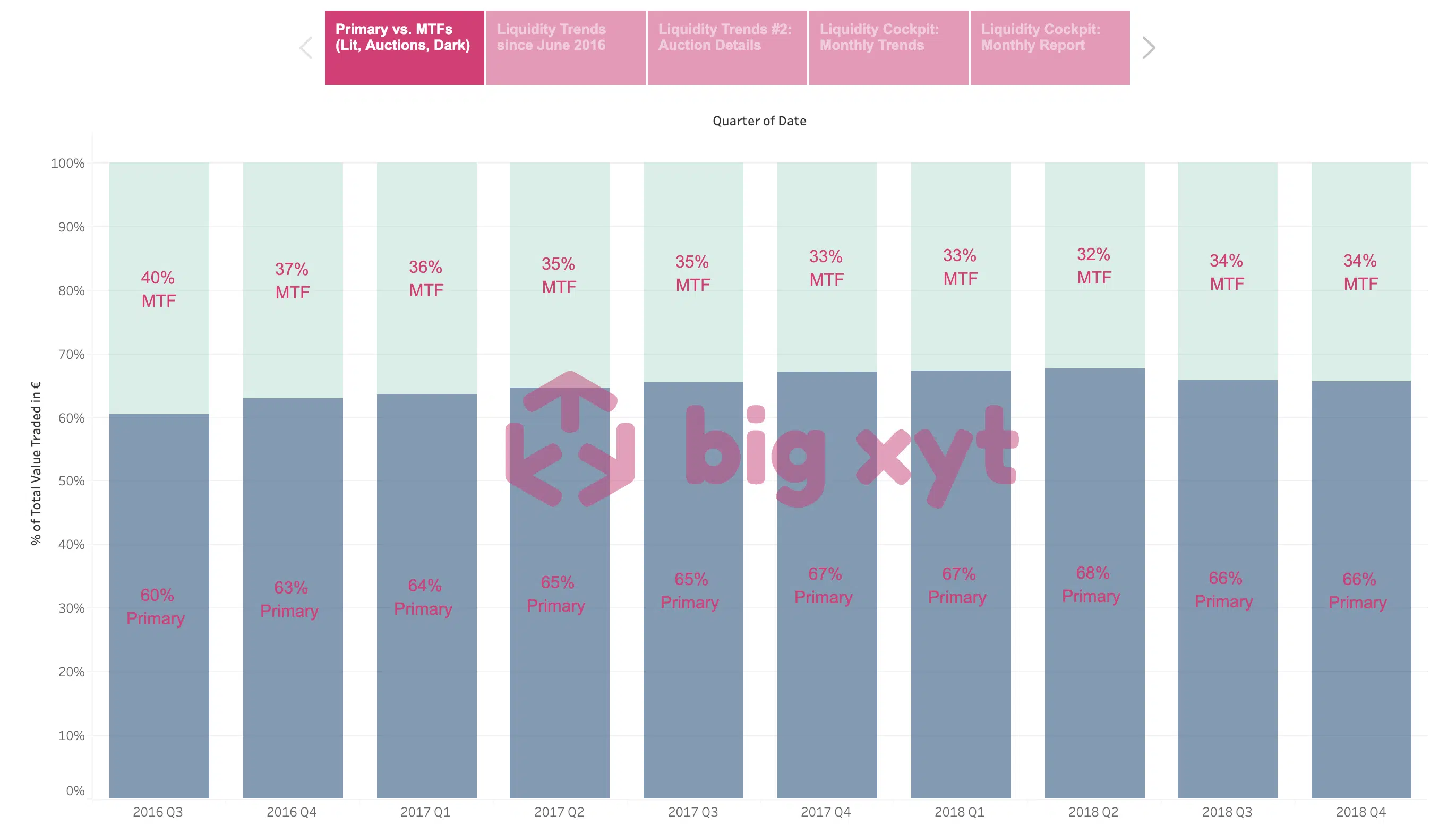

Analysing trading data from multiple points of view one year on from MiFID II London, Frankfurt, 28th January 2019. big xyt, the independent provider of high-volume, smart data and analytics capabilities is pleased to announce the launch of www.250days.com, a collection of views reflecting the evolving market dynamics over the past year. The new site leverages the Liquidity Cockpit, the industry recognised reference for independent market structure analysis, and has been created in response to multiple client requests. Visitors will have access to annotated visual analysis of the fragmented European equity trading landscape leading up to and during 2018.