Robin Mess, our CEO, will speak about navigation in a dynamic liquidity landscape (pre and post MiFID II) and how analytics helps to optimize trading performance. In the afternoon Robin will share thoughts on the dynamic liquidity landscape: Fragmented liquidity and the emergence of new venues and order types like periodic auctions, dark pools or LIS venues, are not new to Pan-European trading. With MiFID II we will see further changes with an increasing complexity (e.g. restricted dark pool trading, DVCs). In this dynamic liquidity landscape, trading firms have to overhaul their existing strategies. We show how technology and independent analytics can help the trading community to optimize execution and trading performance.

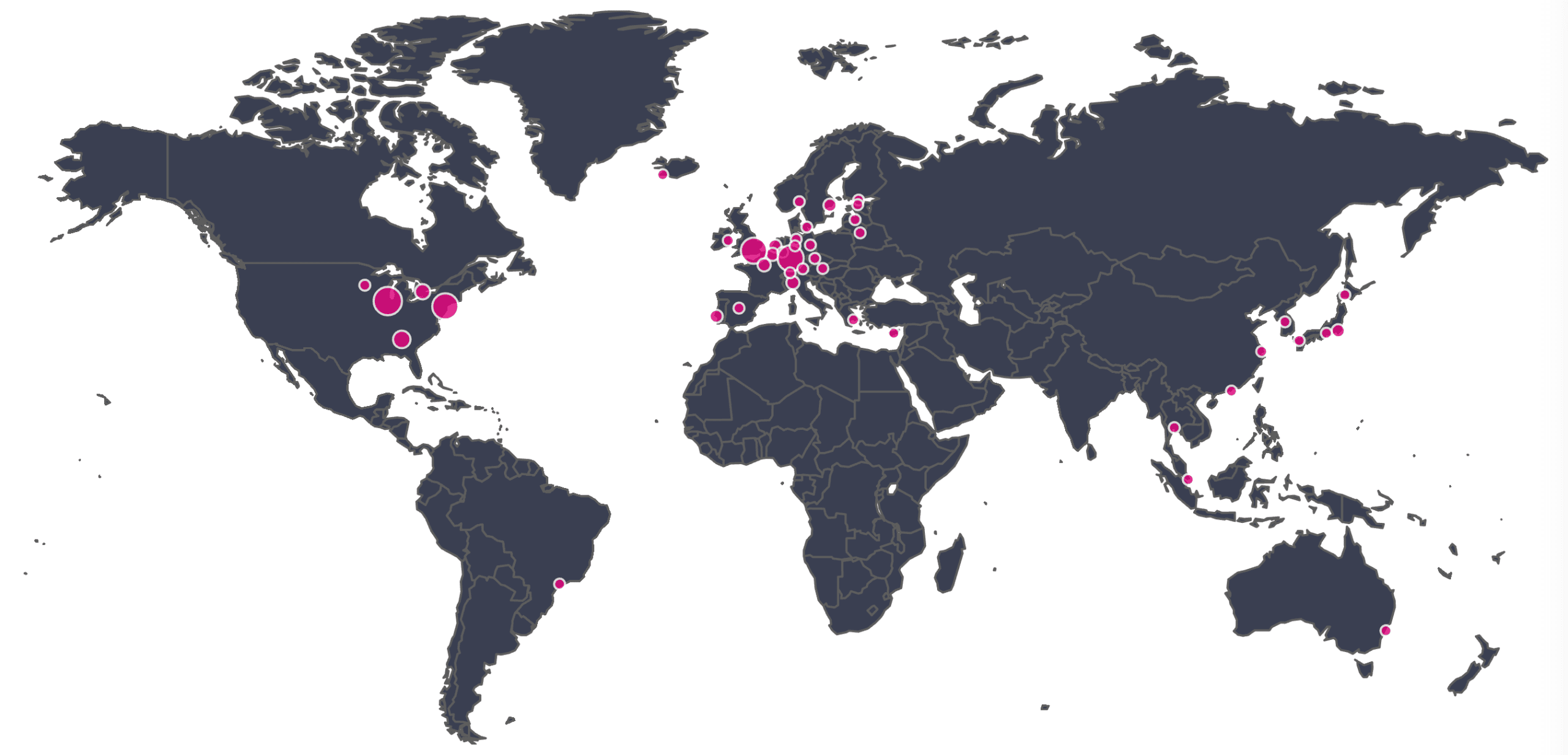

London, 25 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, announced today that SIX Swiss Exchange has joined the xyt hub to provide high quality tick data to its trading participants, enabling them to develop, evaluate and backtest new trading and execution strategies while providing greater transparency over trading activity. Connected to more than 100 venues globally and across asset classes, the xyt hub launched in September 2017 to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities.

London, 14 September 2017: big xyt, the independent provider of high-volume, smart data and analytics capabilities, today announced the launch of big xyt hub to enable the global trading community to integrate tick data and analytics in a more convenient and cost-effective way, via a single API. The xyt hub allows trading firms to consume, analyse and visualise all the data they require through cloud-based technologies, featuring Data-as-a-Service and Analytics-as-a-Service functionalities. Advances in algo development, testing and optimisation, transaction cost analysis (TCA) and regulatory reporting are increasing the demand for robust, independent data and analytics. With the big xyt hub, trading firms and exchanges can immediately access tick data and analytics, without costly investment into in-house data infrastructure and storage, technology capable of managing tick data with nanosecond precision and market-by-order granularity, or indeed additional staff.